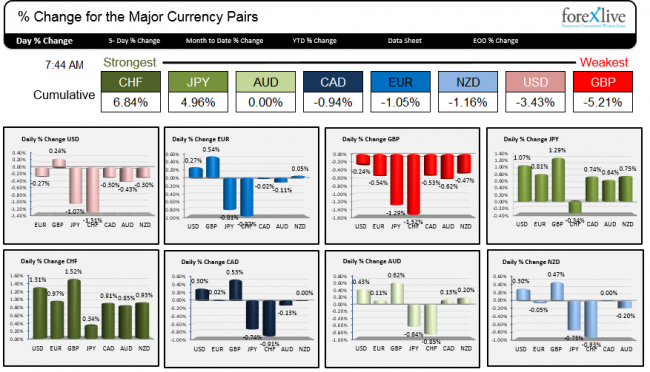

The strongest currency is the CHF. Yesterday the pair corrected back lower against most currency pairs but could not sustain rallies. That set the stage for further weakness in European trading today. WIth ECB decision around the corner, the EURCHF will likely remain more pressured.

A snapshot of the strongest and weakest currencies as NY traders enter for the day.

The weakest currency is the GBP. In the minutes of the last BOE meeting, Martin Weale and Ian McCafferty did not vote in favor of a rate hike on the back of lower inflation expectations (see: BOE MPC Minutes : Voting to hold interest rates changes to 9-0 ). Wage data for November also showed that Weekly earnings ex bonus came in at 1.8% vs 1.9% – helping to weaken the GBP.

The BOJ lowered their inflation expectation and did nothing on rates. The gains in the USDJPY from yesterday were reversed on the decision.

The USD is lower on the day – only rising against the GBP. The EUR is more mixed with gains against the USD and GBP. Traders will be busy today setting up for the risk event tomorrow when the ECB announces their next policy move with QE expected. The Deutsche Bank CEO said 750B is priced in, 500 would be a disappointment and 1T would be “bullish” (I presume for the EU not the currency). There is some debate on whether his assessment of 750B is really priced in as most estimates are in the 500 to 550 variety. Hence the added risk associated with the decision tomorrow.