The numbers hit with USD/CAD at a 5-year high near 1.2450.

- Prior core +2.1% y/y

- Headline CPI 1.5% y/y vs 1.6% exp

- Prior headline +2.0% y/y

Month-over-month

- Core -0.3% vs -0.3% exp

- Headline -0.1% vs -0.3% exp

- Prior headline -0.4%

- Non-seasonally adjusted headline -0.7% vs -0.4% prior

The numbers highlight that slow growth is more of a factor for the Bank of Canada than inflation in the near-term, although two consecutive months of price declines are hard to ignore.

Still, there is nothing here that would make the Bank of Canada hit the panic button and the retail sales report was very strong. The BOC will be assuming that pipeline pressures due to low oil drive down prices but the exchange rate may have the opposite effect when all is said and done.

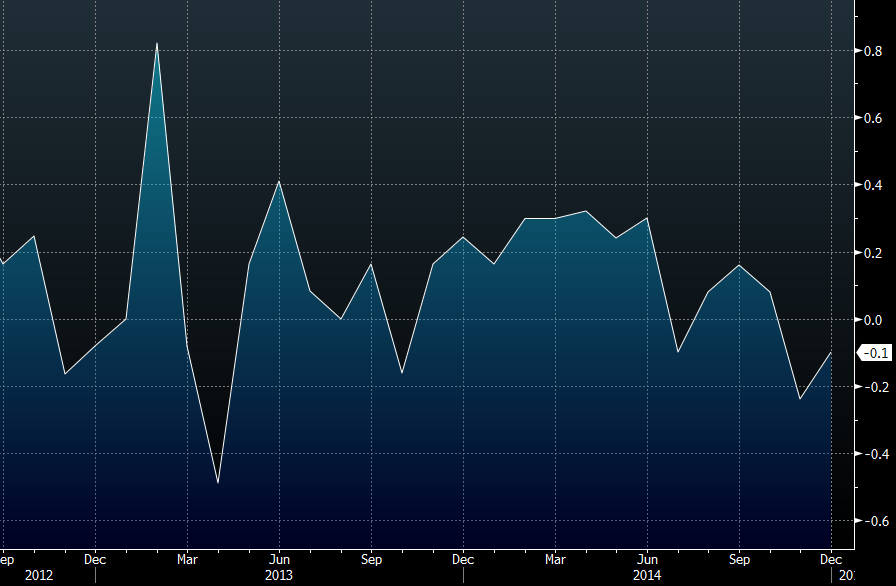

Canada m-m CPI seasonally adjusted

This number would have had much more impact if it came before the Bank of Canada. I assume Poloz & Co had the data before Wednesday’s decision.

What we don’t know is what the BOC will do next. There wasn’t much talk about it at the press conference although Poloz said officials said they would be willing to take out more ‘insurance’ if needed. But just characterizing it as insurance puts them in more of a wait-and-see mode. If oil prices fall, or even just stay low, then that’s probably more important then near-term CPI data.

USD/CAD has fallen a half-cent since the numbers back to 1.2400. Retail sales is the driver moreso than this data.