Adam and I are stepping on each other’s toes with this one, but as always, he makes some good points on the fundamental front for the EURCHF. I will take a closer look at the technicals and express what they are saying to me….Sorry for the doubling up Adam!.

The EURCHF is making a further break higher after moving above the 100 hour MA in trading today (blue line in the chart below). That break (it was many pips ago at 0.9962) was the first look above the MA line since the de-pegging, and it certainly contributed to traders feeling more and more comfortable about the potential for further gains in the beaten down pair.

When a currency moves 3500 pips in a matter of hours, a corrective move that is even relatively minor is a pretty big move. The range today for the EURCHF is around 385 pips. That is certainly nothing to sneeze at but the pair is still 1850 pips from whence it all began at 1.2000. The Swiss finance minister commented that she thought 1.1000 was a fair price. I don’t know about that, but there is room to roam if the bulls can remain in control.

EURCHF strings together 8 up bars.

Now what? What would keep the bulls in control?

First, the buyers in the pair have indeed made it look easy. The last 9 hourly bars are all up. That started way down at the 0.9851 level. The high just reached on the last hourly bar, equaled a swing high from Jan 20. So this will be a level that might test the buyers “will to continue the trend” after the strong move higher.

If the price is able to slice through that level, the 1.02208 high from last week will be the next target. My 200 hour MA – for the curious minds – is at 1.0292 currently. Note, however, that the 200 hour MA is still influence by what happened on the day of the Swiss de-peg. So hourly bars from back then are questionable. It wont be for another day or so before all the Jan 15 stuff is out of the 200 hour MA calculation. We can then get back to more normal and trusting MA (PS. Bloomberg has the 200 hour MA at 1.0200).

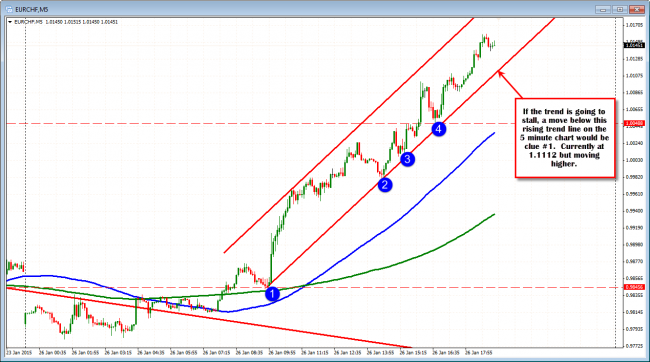

The current hourly bar was just completed with a close at the 1.0144. This will be the bogey for the current hour to see if the string of 9 straight up bars can continue. Looking at the 5 minute chart below, the lower trend line currently comes in at 1.1112 (and moving higher). A break of this line would be another clue that the trend might be over.