Saxo Bank will attempt to recover negative client account balances and will take legal action if necessary, executives continued to emphasize today. The company lost an estimated $107 million as the franc cap was lifted but maintains that it holds enough cash to meet capitals requirements.

We’ve been told Saxo sent traders with negative balances of less than $100,000 a list of 3 options:

1) 80% pay now and receive 20% haircut ( with all ‘negative’ interest and conversion rates waved )

2) 50% pay now, 40 pay till 31/3 and receive 10% haircut ( with all ‘negative’ interest and conversion rates waved )

3) 25% pay now, 25% by the end of each quarter with conversion fees to be waved but the ‘negative’ interest still in place)

That doesn’t sound like a great deal.

Bloomberg spoke with executives today:

“It’s not unlikely that we’ll face legal challenges,” Steen Blaafalk, Saxo’s chief financial officer and head of risk management, said in a phone interview. “If we need to debate it through such a channel, we will of course do that, but hopefully we don’t have to and we are actively working with clients to find a plan of action for repayment.”

Last week, Blaafalk said the loses were immaterial even if they weren’t recovered, but said they would be going after them anyway.

We are still liaising with those clients to settle unsecured amounts and status is that we expect that some clients will not be able to the settle the balance in full and that the bank will incur losses in this respect. But as we indicated late last week, those amounts are relatively immaterial to Saxo Bank overall.

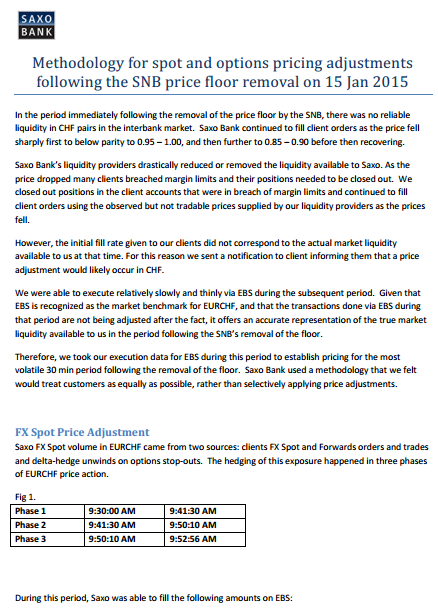

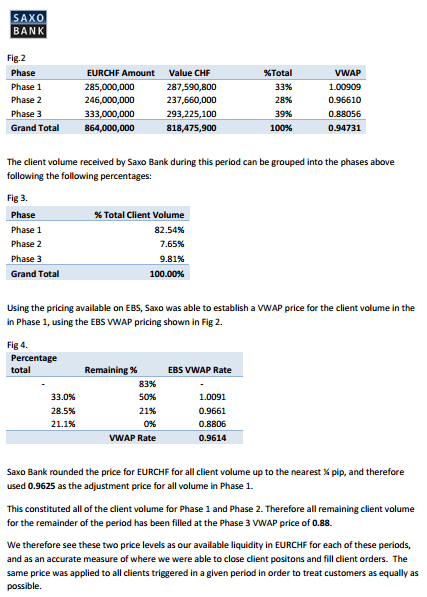

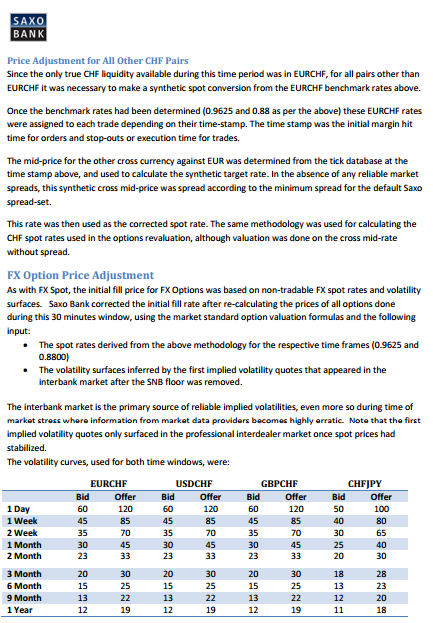

Saxo Bank is also under fire for adjusting the rates of EUR/CHF trades around 12 hours after first confirming them — often at a -2000 pip difference. The following is how they’ve justified changing their prices.

We sincerely hope Saxo Bank reconsiders.