Forex news for January 27, 2015:

- December 2014 US durable goods -3.4% vs 0.5% exp m/m

- Cap goods orders non def ex-air -0.6% vs 0.9% exp

- January 2015 Us Richmond Fed manufacturing index 6 vs 5 exp

- January 2015 Us consumer confidence 102.9 vs 95.5 exp

- January 2015 US Markit services PMI flash 54.0 vs 53.8 exp

- Dec US new home sales 481K vs 450K expected

- November 2014 US Case/Chiller house price index 0.74% vs 0.60% exp m/m

- French jobseekers +3495K vs +3488K exp

- NYSE looking to apply rule 48 on expected volatile trading

- Turns out Liquid Markets wasn’t so liquid after all

- JPMorgan made $250-$300 million on the Swiss turmoil

White House to approve offshore oil from Virginia to Georgia - Saudi Arabia secretly ups oil production

- Saudi oil minister met with Russian and Norwegian counterparts

- Bank of Italy’s Panetta says ECB measures will support growth for next 2 years

- EU and Greece had secret deal to delay debt payments

- S&P 500 down 27 points to 2030

- WTI crude up 66-cents to $45.80

- Gold up $11 to $1292

- EUR leads, USD and AUD lag

The two day Fed meeting began and officials were given some very different readings on the economy. The durable good report was dreadful with a poor headline, revisions and details. Meanwhile, new home sales and consumer confidence rose to post-crisis highs.

The market was in a bad mood before the numbers as companies warned about a drag from FX and that gave the yen a broad-based bid. For US dollar traders, the durable goods numbers probably carried the most weight and led a squeeze on the US dollar.

Traders are worried about the Fed taking a more-dovish stance and that led to a big bounce in the euro and sterling.

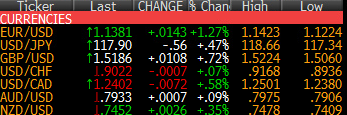

EUR/USD began the rise in Europe on a squeeze above 1.13 but had pulled back to 1.1280 as New York traders arrived to their (home office) desks. The rally soon resumed and reached all the way to 1.1422 just ahead of the London fix. It sagged back down to 1.1377 from there.

USD/JPY was in a relatively quick dive down to 117.33 but repeatedly found bidders there and sprang back up to 118.00. Even selling in the stock market late didn’t do much to move the needle. Feels like we’ve been stuck close to 118.00 for too long.

Cable is like a pheonix rising from the ashes as it cranked it all the way up to 1.5223 from 1.5080 in early US trade. On Thursday it was at 1.4950 and technically today’s rebound is enticing because it broke some of last week’s highs.

The Canadian dollar finally caught a bounce after USD/CAD failed in an attempt at 1.25. The oil market rallied on some flimsy headlines and loonie traders decided to take some profits.

Check out our Fed preview.