EUR/GBP has been a great short trade going back to 2013. I still feel there’s good value in it but the clock is ticking.

I believe the final hurrah for shorts will be if/when the UK interest rate picture is decided. Looking at the charts there’s three potentially very strong levels that will need to be cracked so we can continue south. They are big enough that it will have me evaluating my current shorts and whether to take some or all off the table.

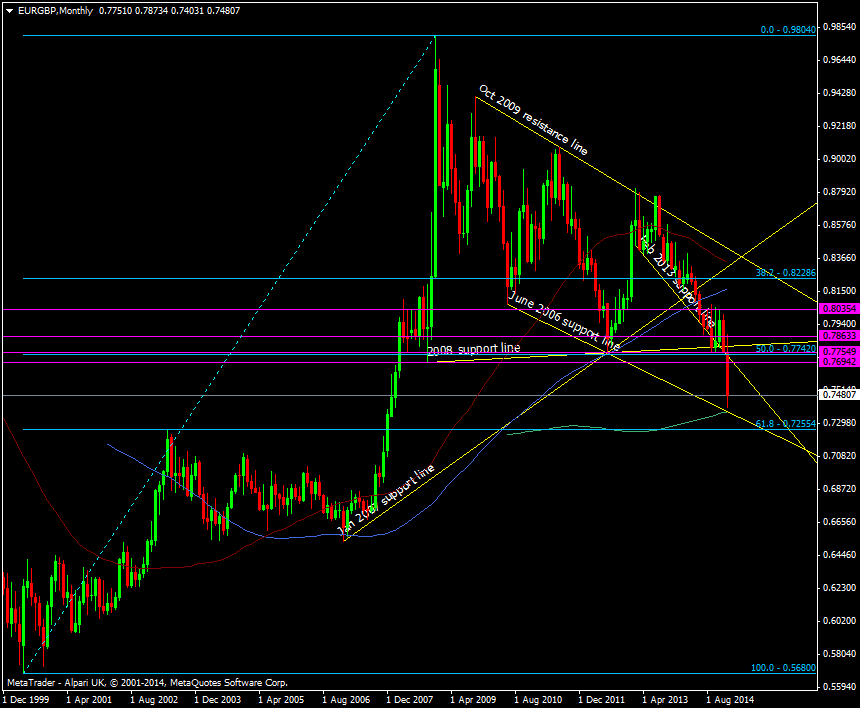

EUR/GBP Monthly chart 28 01 2015

The 200 mma has met the June 2006 support line around 0.7370. Just a bit further south is the 61.8 fib of the 2000 swing up at 0.7254. That level was also a prior long term resistance level being the 2003 high and around the weekly highs in Nov/Dec 2007, before the break up to the 0.80’s.

If I wasn’t short I’d be looking to take a long from these levels as they do make a very good technical case for longs. I may even do so and turn my position around. It’s all a question of timing though so let’s look at some of the factors and the pros and cons of maintaining a short position.

Pros

- UK is still doing reasonably well so rate rises are still on the cards

- Even if UK rates get pushed back they will come ahead of Europe

- The euro in general is still under the ECB QE/easing cosh

- Inflation is more of a risk to Europe than the UK

Cons

- ECB QE could finally put a floor under falling inflation and the economic slump

- If Europe does pick up the overall scale will be bigger than the UK and that will send EUR/GBP soaring

- The euro has been falling for a long time, nothing goes down forever and is nearing the scale of drop we saw when the crisis first hit

- Although temporary, the UK election could weaken the pound

On balance I still find value in shorts but as we’re close to these levels, and the time frame of the UK elections, it could warrant a long from them to ride any election sterling weakness, to then reverse that into shorts for the election result and then BOE rate rise.

The main gist is that this tech cannot be ignored if you’re short and so we need to look at how to profit from it by using the levels to our advantage. Being flexible a key component of trading even if it goes against you directional bias at some points