Not many people out there are recommending euro longs but BAML is out with a couple of reasons to be worried if you’re short.

1) They note that last week’s inflows into European equities were the largest since June and included both the core and periphery. “We have argued that open-ended QE is negative for the Euro, but persistent equity inflows could slow and eventually even reverse the downward EUR trend,” they say.

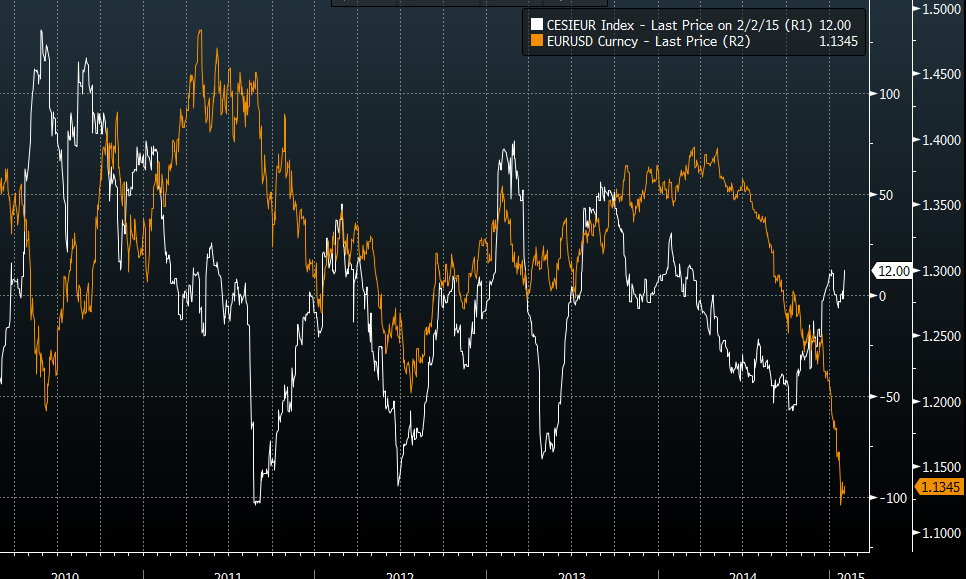

2) Economic surprises are reversing. “US data surprises went into negative territory last week for the first time since August, whilst EZ data surprises are back in positive territory for the first time March 2014,” BAML says.

There is at least some correlation between the euro and the Citigroup economic surprise index.

EUR vs economic surprise index