Reserve Bank of Australia Statement on Monetary Policy (SoMP)

- Judged holding policy steady consistent with growth, inflation targets

- Says has balanced low inflation against risks of rising household debt

- Says recent rise in AUD has had modest dampening effect on economic forecasts

- Says further rise in AUD would lower economic growth, inflation

- Says expects underlying inflation to reach around 2 pct in 2H 2017, rise a little thereafter

- Utility prices to rise more than first thought over next few years, make large addition to CPI

- Sees economy growing around 3 percent for next two years

- Sees unemployment little under 5.5 pct by end 2019, recent jobs data provides more confidence

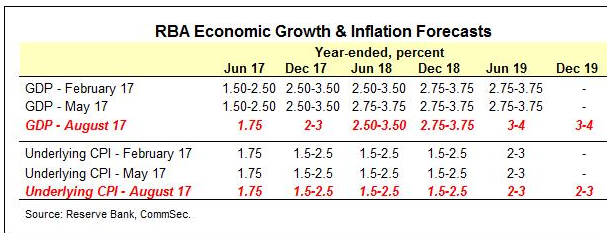

- Trims GDP forecast for December 2017 to 2-3 pct, December 2018 unchanged at 2.75-3.75 pct, 2019 raised to 3-4 pct

- Underlying inflation forecasts unchanged at 1.5-2.5 pct end 2017 and 2018, 2-3 pct by end 2019

- Forecasts based on technical assumption of AUD staying at $0.8000

- Says GDP growth looks to have picked up in Q2, weakness in Q1 was temporary

- Says recent increase in employment supporting household incomes, consumption

- Says wage growth expected to remain subdued, increase only gradually

- Sees private sector wage growth broadly unchanged over the year ahead

- Public investment to be higher than expected, have positive spillover effects

Quick Headlines via Reuters

--

Also:

- Lowers June 2018 GDP forecast to 2.5-3.5% from 2.75%-3.75%

Added - this via CBA (Commsec);

--

Ok, so that first line ... "Judged holding policy steady consistent with growth, inflation targets" ... just a personal bugbear ... if they hadn't judged it consistent then they wouldn't amIright?

OK, moving on ....

- A bit of AUD jawboning ... pretty weak

- GDP expectations lowered a touch, those for inflation left untouched

- Some positive comments on the employment outlook but not so rosy on wage growth

A timid statement but there you go.

--

AUD is a little lower (it had been trading lower, well, off its highs at least, ahead of the releases).

I'm looking at it thinking there is a good amount of resistance for it now ... but all it takes is for more idiocy from the oafs in Washington for the next leg up and if the trend is your friend then I won't be getting short US idiocy. Congress and the Pres are going on holidays now for a month or something, so maybe there is hope of a cessation of manure flow.

Huh ... I think I need to weekend, bring it.