I'm just digging around on anything other than the kiwi and the aussie :-D

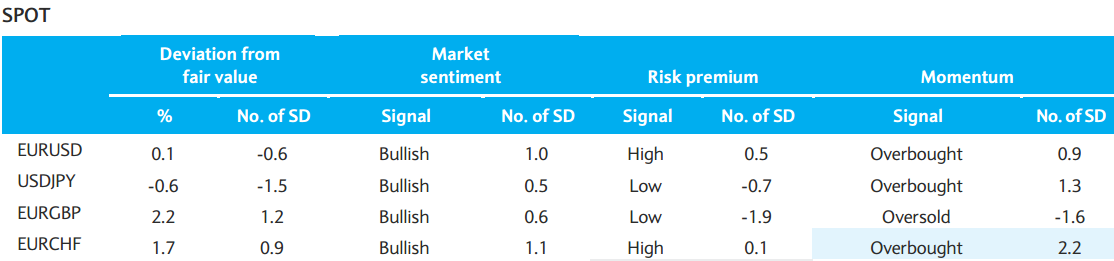

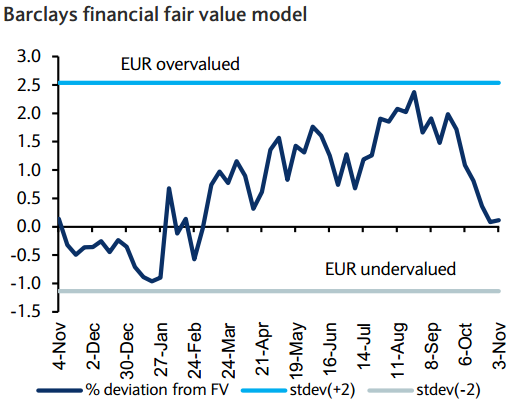

Via Barclays quantitative research (The FX Quantitative Analyzer ) ... this snippet:

and

- EURUSD is trading near its estimates of fair value, according to our FFV model

---

And, this snippet via Commerzbank on the EUR also

- The ECB is likely to be generally pleased, as it has managed to reduce its asset purchasing programme further without this causing major distortions on the market - i.e. a strong rise in yields and euro exchange rates.

- The euro even eased as a result of the meeting two weeks ago, which is likely to suit the central bankers well.

- ... the ECB has made it clear that interest rates will only start rising long after the end of the asset purchasing programme. So until an end of the purchasing programme is in sight the first rate hike seems an increasingly distant prospect. Bad news for EUR bulls.

I haven't bolded anything .... bold anything you like and stick it in the comments! :-D