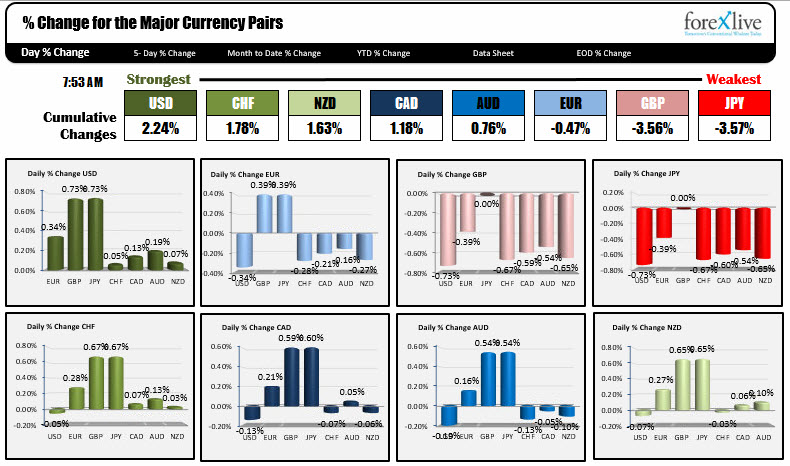

The strongest and weakest currency rank before US retail sales

The UK inflation data showed less than expected inflation numbers and that hurt the GBP. The USDJPY and JPY pairs moved higher from the start of the Asian session. The stock markets are higher, yields are higher and gold is getting hit again. That is contributing to the flight out of the JPY and it is also helping the USD. Data at 8:30 AM ET/1230 GMT (retail sales, Empire Manufacturing and Import/export price indices) could derail the trains.

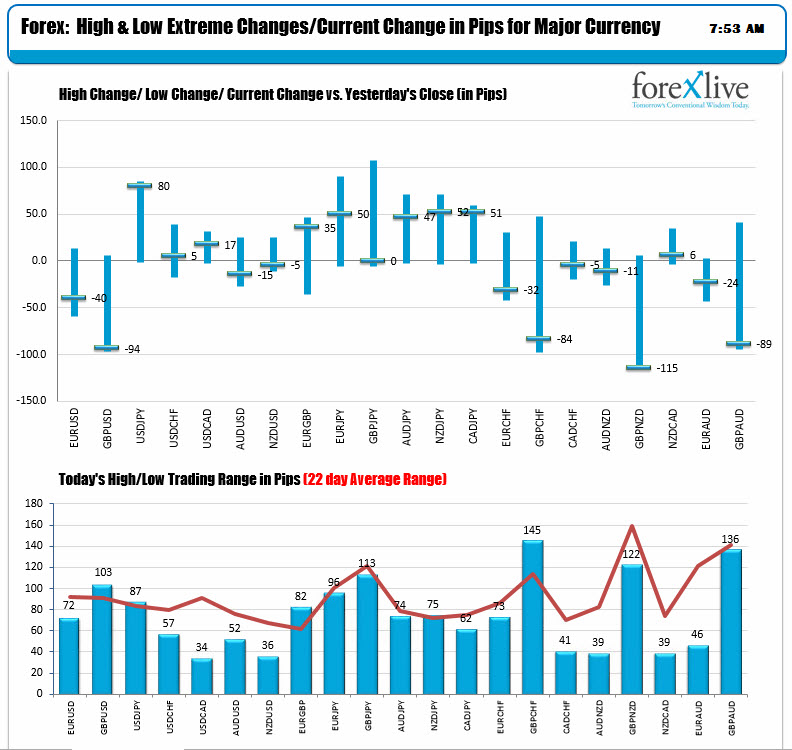

The changes and ranges are showing some decent activity. The EURUSD, USDJPY, GBPUSD and a number of crosses have reached the 22 day average trading range targets. The GBP pairs are trading near extremes.

IN other markets today, a snapshot shows:

- Spot gold is down -$9.00 to $1273

- WTI crude is trading down -$0.31 to $47.28

- US yields are higher. 2 year is up 1.6 bp to 1.334%. 5 year is up 3 bp to 1.798%. 10 year is up 3.3 bp to 2.2518%. 30 year is up 3 bp to 2.836%

- US pre-market stock indices area higher. S&P futures are up 5.5 points. Nasdaq futures are up 17.50 points, and the Dow futures are up 50 points.

- European stocks are higher. Dax is up 0.30%. Cac is up 0.4%. UK FTSE is up 0.5%. Yields in the 10 year sector are higher. Germany up 3.4 bp. France up 3 bp. UK up 2.7 bp. Italy up 3.3 bp. Spain up 3.7 bp.