Federal Open Market Committee and inflation day in the US on Wednesday

I posted u some previews so just collating them all for your ease of clicking!

FOMC:

GS:

Barclays

HSBC:

And, an added one:

Rabobank:

- We expect the FOMC to change the target range for the federal funds rate to 1.25-1.50%, from 1.00-1.25%.

- Since this hike has been well telegraphed by the Fed, markets are likely to focus on the fresh set of projections, in particular the dot plot.

- Do the FOMC participants still expect to hike 3 times in 2018? The meeting will be concluded by Chair Yellen's final post-meeting press conference. Since she will leave the Fed in early February, her words may not carry the weight that they had previously.

And, another:

RBC:

- The FOMC meeting is the highlight of the week but it is likely to come and go with very little fanfare. An increase in rates is baked in the cake with the market pricing in 98% odds of a 25bps hike, according to Bloomberg. Likewise, Chair Yellen's press conference should prove to be a nonevent. She just testified before the Joint Economic Committee (Nov 29th) and thus her most recent views are out there and well-known.

- She is also leaving once Powell is confirmed (really a formality now as his nomination cleared the Senate Banking Committee with a bipartisan 22-1 vote) so expect the news conference to look more like a deferential sendoff than a grilling.

- The bigger question is whether the Fed will significantly alter their economic and rates projections. We think not and believe it is more likely the committee will seek flexibility on this front and wait until March to make significant upgrades.

- For starters, the Fed will want to wait until they can model the impact of the looming tax plan. Even if it is signed into law by the time the committee meets, there will not be enough time to do a proper vetting of what the plan means for economic growth/inflation/rates. Moreover, by waiting until March to release new estimates, the Fed can still maintain flexibility to raise rates 4 times next year or not.

- Contingent on tax policy being signed into law, we think members will be out in force on the speaking circuit promoting their upgraded views on the economic backdrop, thus moving the probability of a March hike up sharply through early 1Q (it's around 60% at present). Then they couple a hike in March with a boost in growth/inflation and their dots profile (moving to 4 hikes in 2018).

This one is FOMC and CPI, bargain!

(UBS)

And, CPI:

- US data due Wednesday - inflation! Here's a preview (or 3)

- US data due Wednesday - inflation! Here's another preview

Plenty of politics too in the US on WednesdaY:

- Trump, House & Senate tax negotiators to meet Wednesday

- Heads up for US President Trump to speak on Wednesday - on tax

Speaking of politics, we are still awaiting the results of the senate race in Alabama, counting underway, here is the latest:

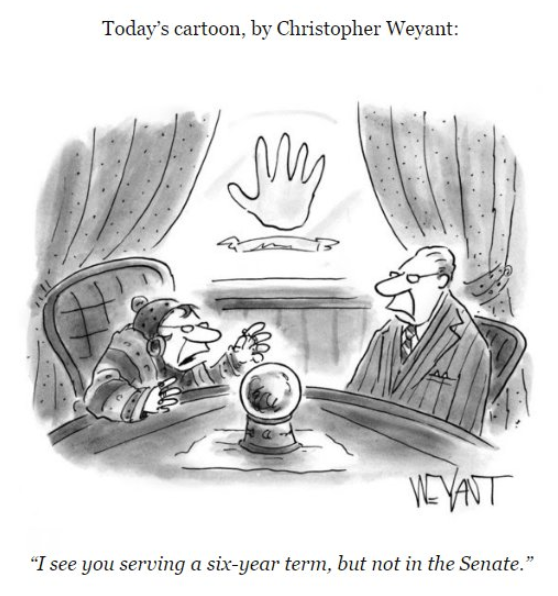

And, finally, a LOL from the New Yorker: