Fund manager Nader Naeimi from AMP Capital Investors spoke to Bloomberg TV earlier

He says that the firm has closed its 'strong long positions in the Japanese yen' and adds that he expects the currency to weaken before resuming its strength.

In his words, he says that "I will probably see yen trading at 112 before trading at 100". Naeimi also says that the probability of Japanese prime minister Shinzo Abe being forced to resign over the Moritomo issue is almost zero.

However, he does say that "from a long-term standpoint, the yen is so very cheap" - arguing that there is a large amount of QE currently priced into the currency. With that said, he states his long-term view that there is room for the yen to strengthen; first getting to 100, and potentially breaking 100 is a "strong possibility".

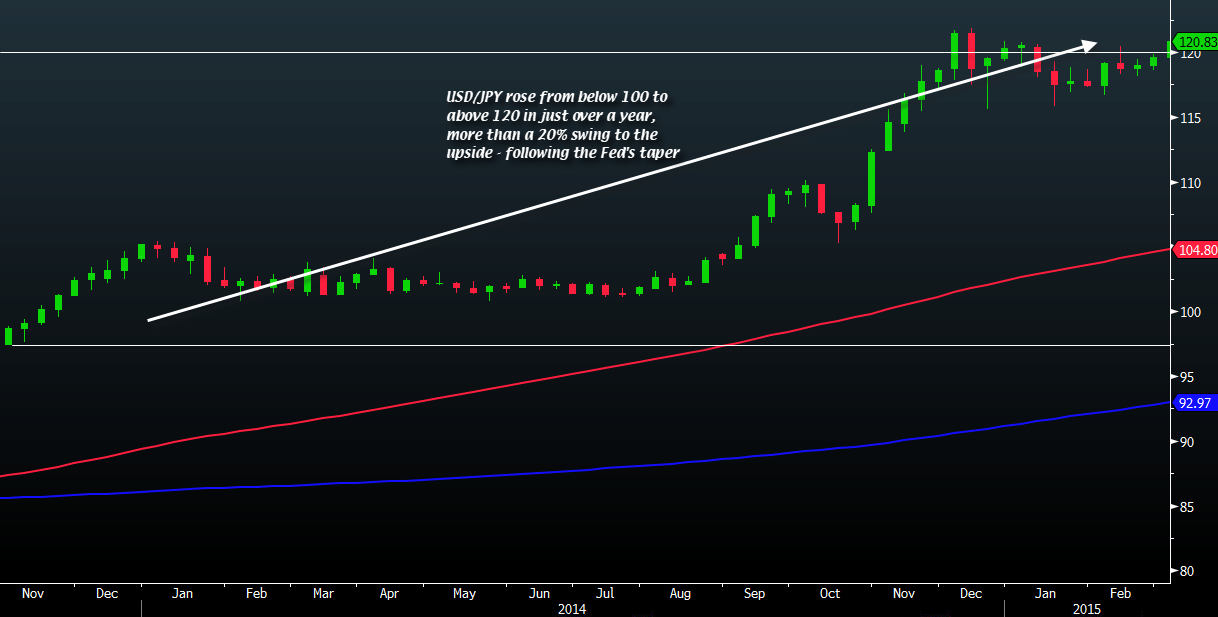

His last point is a view that I can share, with USD/JPY still relatively elevated in the macro picture over the last five years or so. And should the BOJ start to normalise policy, the yen is going to make big waves in the currency market - quite possibly something that we haven't seen since the Fed decided to taper back in late 2013 to 2014.

But the real question will be, can the Japanese economy even get there? Or more importantly, can inflation even get close to the 2% target set by the BOJ and the government?