I posted earlier on TD Singapore on the Australian dollar: Here's another bank on the RBA yesterday (focus on the AUD & GDP "we see upside")

But ... this is much more focused on the AUD!

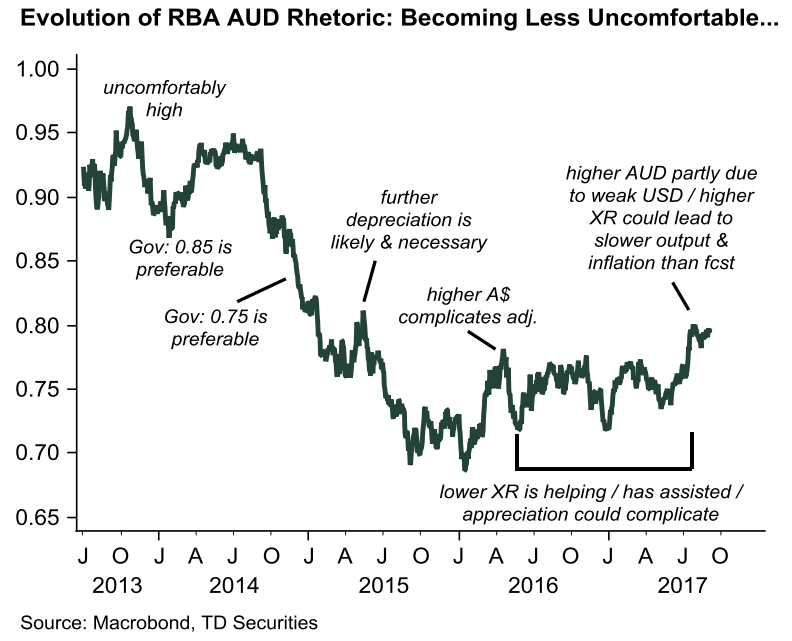

Its from TD in New York, and its titled: AUD: It's Time to Start Looking Higher

In summary (bolding mine):

- We have turned strategically bullish on AUD and adopt a buy -on-dips stance. We now look for AUDUSD to reach 0.84 in 2018. While the RBA is in no hurry to hike, a narrowing output gap and persisting financial stability concerns suggest more fluid risks around the cash rate, which we currently expect will move higher in May 2018.

- This, along with improving macro conditions, a bearish USD outlook and insufficient tightening priced into the front-end, introduces an asymmetric risk return profile for AUD that leans higher.

- This leaves AUD prone to a policy "catch-up" play in G10FX and be primarily observed in AUDUSD as Q4 approaches. Elsewhere, AUDNZD is likely to remain elevated in the near term as the Election dominates the kiwi-leg. We see AUDCAD topside back-loaded in the year.