The Reserve Bank of Australia monetary policy meeting is Tuesday 6 March 2018

- Decision and statement are due at 0330 GMT

This (quickie) via National Australia Bank (bolding mine):

RBA board meeting this Tuesday

- and Wednesday's speech by Governor Lowe on investment are highlights.

The post-meeting statement will be examined carefully for the RBA's reaction to recent underwhelming wages data - likely to confirm that these data are showing the slow "gradual" improvement they expected.

In contrast, the RBA narrative around GDP has been much more optimistic, and increasingly confident.

The RBA expects GDP to accelerate to 3¼% y/y by the end of 2018, from a current growth rate of 2¾% y/y.

- The growing confidence reflects signs that the drag on growth from the end of the mining investment boom has all but disappeared, with the mining states are clearly on the road to recovery.

The shift from mining investment to non-mining (particularly services) investment could be a highlight in Governor Lowe's speech on Wednesday morning, prior to the Q4 GDP print.

We expect the tone of the speech to be optimistic, highlighting growing non-mining investment and the large infrastructure pipeline, which has had positive spillovers for businesses.

And, NAB on Wednesday's GDP (in brief again)

- RBA will be looking for robust investment growth in the GDP figures.

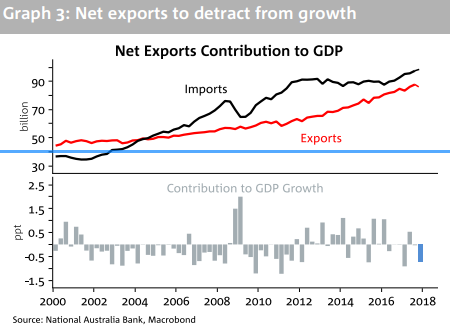

- NAB's forecast of 0.7% q/q growth relies on a pick-up in consumption growth (1.0% q/q) and solid underlying investment growth (1.4% q/q), to offset the detraction from net exports (-0.8% q/q).

- Consumption strength this quarter (after a weak Q3) is particularly important, the RBA sensitive to a degree of consumer fragility. Stronger consumption growth will play to the theme that consumer spending has some resilience.