Reserve Bank of Australia minutes of the February 2018 Monetary Policy Meeting are due at 0030 GMT

I dunno about anyone else but I am getting sick of the one-line previews which all basically say ....

- RBA Board minutes seem the unlikely to cast much additional light on the policy outlook

That's via Daiwa, but Bank of America / Merrill Lynch say the same thing:

- expect little new information from the minutes from that contained in the quarterly update

As do the big four here down under:

- ANZ say the minutes are unlikely to add much to recent RBA communications

- Westpac are looking for more detail regarding uncertainties around recent forecasts

- NAB say the minutes are unlikely to differ from consistent RBA messages over the past couple of weeks

- CBA says the minutes are likely to stay with the upbeat tone for the growth outlook given ... last Friday's Statement on Monetary Policy (SMP)

So, I might be sick of it ... but it is what it is.

Later in the week we have items that should be a bit more of focus

- Q4 wage price index (Wednesday 0030 GMT )

- Q4 Construction Work Done (also Wednesday, same time)

Preview of the wages data via NAB (bolding mine):

- expecting a 0.5% q/q increase in the December quarter

- bringing annual growth to 2.0%, well below its long-run average of 3.3%

we see some slight upside risk to the forecast

- In the September quarter, a minimum wage increase of 3.3% came into effect, the biggest increase since September 2011.

- Despite the large increase, overall September quarter wage growth was only 0.5% seasonally adjusted, a little less than could be expected. As such there may be some additional minimum wage impacts flowing through in this quarter.

- Another upside risk comes from mining industry wage growth, which dipped last quarter and has been very volatile quarter by quarter.

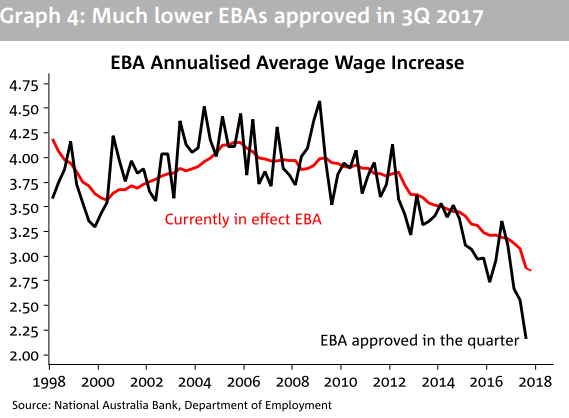

Offsetting these risks, on the downside is the markedly lower average annual wage increase in the latest batch of enterprise bargaining agreements.

- However, this is a small proportion of existing agreements, which in turn are only around 15% of wages.

The bottom line is that it's a bit early to expect much improvement in wages - unemployment will need to fall further to achieve this

-----

Also, NAB preview Construction work done

- expected to decline very sharply (NAB: -15.5%, mkt: -10%)

- easing back from the huge increase in the September quarter, when a couple of one-off LNG platforms were delivered

- This sharp reversal will be partly offset by the large pipeline of infrastructure work, which is expected to support construction for a number of years