Falls back below the 100 day MA too today

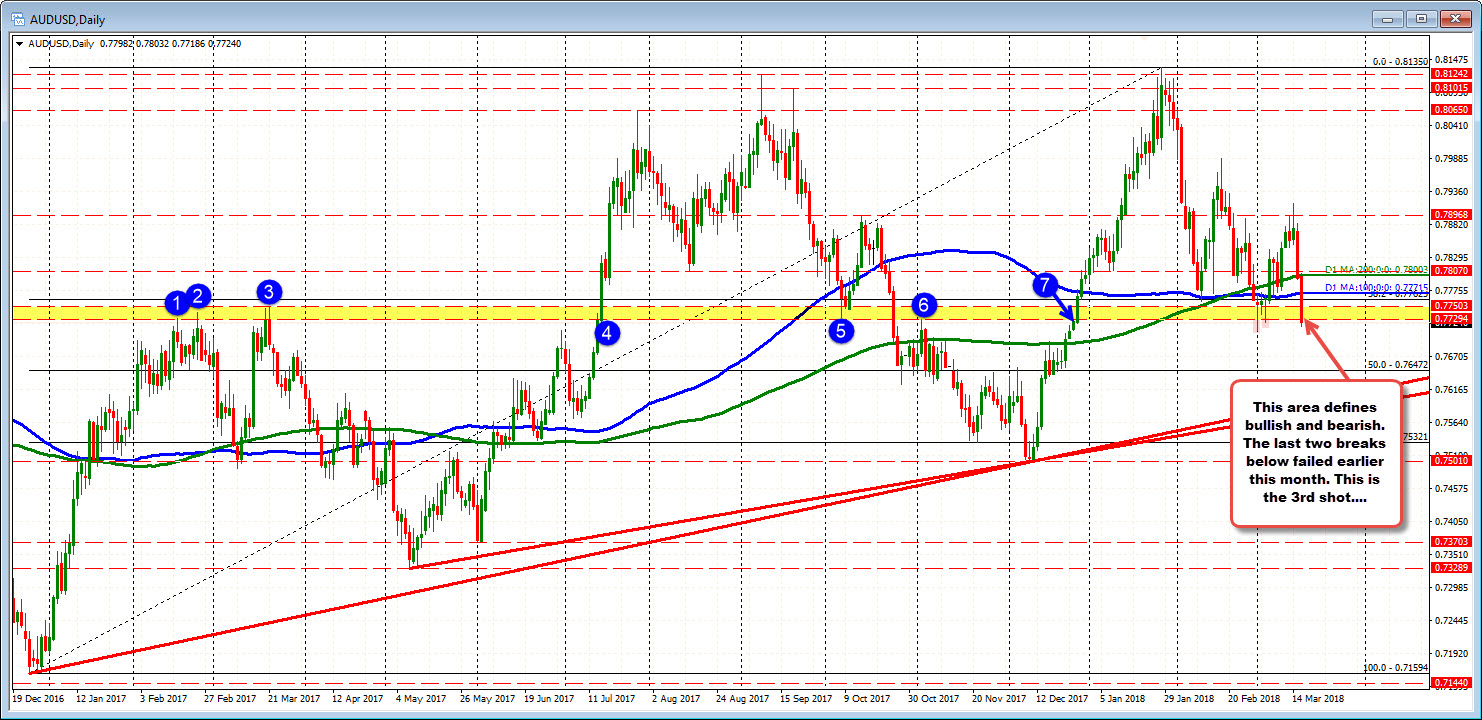

The AUDUSD has trended lower today and in the process is cracking a key dividing area that has split the bulls from the bears.

Looking at the daily chart, the 0.7729-50 area has been that dividing area. Stay below is bearish. Move above is more bullish. Having said that, there were two tests below the area at the beginning of the month. The low on March 1 reached 0.7712. The low on March 5 reached 0.77256. However, by the end of the day, the close had been back above the 0.7750 level (the topside of the "dividing area").

This move is the third break and traders will want to see the sellers stay in control. What would do that? The price can't go back above the 0.7750 level. That is the risk now for shorts looking for more weakness in the pair.

Drilling to the 5-minute chart, helping the downside today was the pair stalling near the 200 day MA at 0.7800 earlier in the session (the high stalled at 0.7803). Also note, the price action around the 100 day MA at 0.77711. That level stalled the fall in the Asian session, fell below the MA and then retested the MA before heading lower. Bearish.

The last leg to the downside has the 38.2-50% correction zone at 0.77389-452. On a bigger correction off the low now, that would be a key resistance target to stay below. A move above (and then the 0.7750 level from the daily) would spell trouble for the bears.