Preview for Australian Q4 2017 company profits, which will go into GDP due Wednesday

Coming up at 0030 GMT, Q4 Company profits

- expected 1.5% q/q, prior 0.2%

ANZ preview:

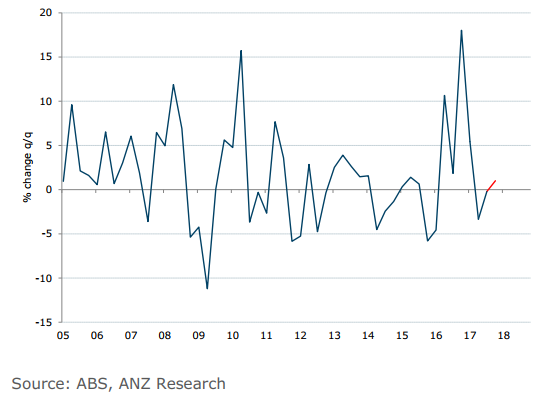

- We are expecting a modest rise in company profits of 1.0 q/q in Q4, following the 0.2% decline in Q3. Commodity prices and volumes were up only modestly in the quarter, but we expect strength in non-mining profits given buoyant business conditions.

Via Westpac:

In Q3, company profits were little changed, -0.2%, to be 1.7% higher for the year to date. Falls in mining (on lower commodity prices) and real estate (as housing cools) were offset by gains across business service sectors.

For Q4, we anticipate a rise of 4.0%qtr, inflated by higher prices boosting the value of inventories (which is booked as a profit). However, on a national accounts basis (abstracting from this valuation adjustment) a more modest rise is likely, around +1.3%.

- Mining profits are expected to rise by almost 6% in Q4, having received a boost from higher commodity prices.

- Non-mining profits are trending higher, supported by a strengthening of domestic demand, but are mixed by industry, given an uneven expansion. For Q4, we anticipate a rise of around 3% (incorporating the artificial boost from the inventory valuation adjustment).

-

There is another input due today, inventory, which I posted on earlier:

---

Also due from Australia today,

And more ...

==

BUT ... apart from Australia .... there are

to be aware of ...