Labour market data for January 2018 due from Australia at 0030 GMT

I posted previews earlier here:

Just wrapping up with a final few now. These via:

RBC:

Employment generation stepped up in late 2017, with employment averaging almost 36k per month in Q4.

Some correction in January is likely, but we are mindful that the leading indicators from the various vacancy data and the employment components of the surveys remain positive while business confidence is strong.

This should temper the degree of pullback in this ever-volatile survey.

- We look for a +10k increase in employment in January,

- with the unemployment rate likely to edge back to 5.4%

- as participation eases slightly from a multi-year high.

Capital Economics:

- 10,000 gain in January

- unemployment rate 5.5%

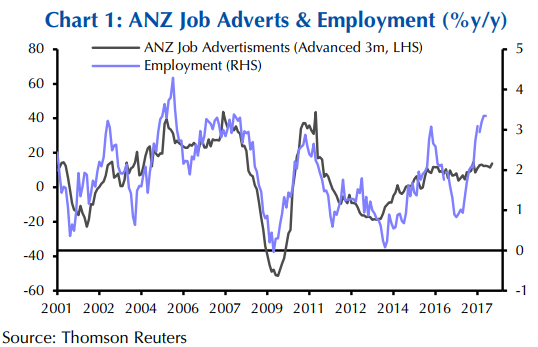

There are few signs that the employment juggernaut came to a sudden halt in January as the evidence from the various private sector surveys has remained buoyant. That said, the surveys aren't consistent with employment continuing to grow at an annual rate of 3.3%. Even the largest monthly rise in the number of job adverts in seven years in January is still consistent with employment rising by around 2.0% a year.

As such, we think the pace of jobs growth will slow this year. That doesn't mean the unemployment rate will rise, but it will probably mean it continues to edge down fairly slowly.

---