I popped up a preview earlier: Australian Q3 inflation report due this week - preview

- Due at 0030 GMT Wednesday 25 October 2017

Check that link for the expected etc. and National Australia Bank's thoughts.

This now via ANZ:

Q3 headline CPI will be boosted by the sharp increases in electricity and gas prices as well as annual rises for property rates and charges and the tobacco excise.

- A seasonal increase in international airfares will also add to CPI.

- Our daily tracking of petrol prices suggests a 2.5% q/q decline in prices in Q3, which will subtract 0.1ppt from CPI.

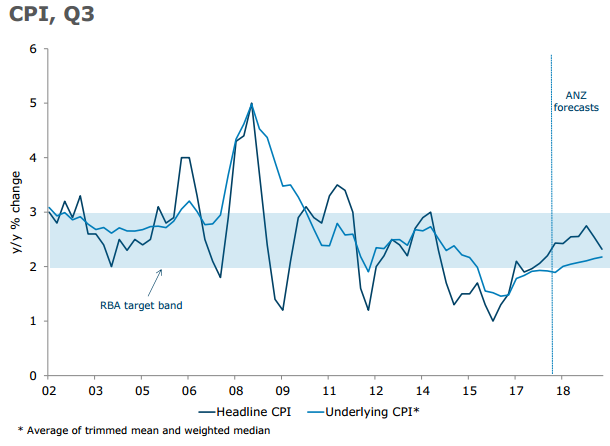

The average of the underlying inflation measures is forecast to have risen by 0.4% q/q in Q3, weaker than the previous quarter, but still sufficient to lift annual growth a touch.

- There appears to be some residual seasonality in the trimmed mean measure, with a step-down in the Q3 readings in each of the past three years.

- As such, a result in line with our expectation probably overstates the weakness in core inflation. Indeed, we continue to believe that core inflation has stabilised, and look for a very gradual lift over the year ahead.

Strategy comments:

- While a number of factors continue to suggest the AUD should be well supported at current levels, Q3 CPI this week could drive some near-term volatility. The headline is likely to be boosted by electricity prices; while core measures should show signs of stabilisation. A sustained broadening in price pressures is, however, unlikely.

- Should the CPI surprise positively, current pricing for the cash rate provides room for AUD outperformance, especially on crosses. Additionally, we will use any minor disappointment as an opportunity to buy.