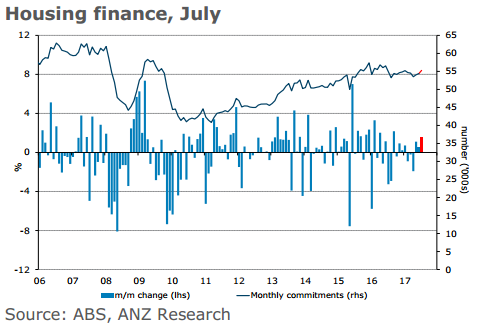

Coming up at 0130GMT 9so, still time for a cup of tea beforehand), July housing finance data from Australia

- Home loans m/m, expected is 1.0%, prior was 0.5%

- Investment lending m/m, prior was 1.6%

- Owner-occupied loan value m/m, prior was 0.3%

ANZ:

- We think the number of housing finance commitments rose further in July, marking a third consecutive monthly increase.

- As we highlighted last month, the improvement in housing finance could mean that we have already seen most of the declines in the building approvals cycle.

Westpac:

- The number of housing finance approvals to owner occupiers edged up 0.5% in June but with the detail more positive, approvals ex-refi up 1.9% and investor loans and construction related loans also posting solid rises. Note that the first round of mortgage interest rate rises associated with macro prudential tightening measures came through in late March with a second round of changes only coming in late June

- The July update should provide more clues as to the impact of these measures although its still likely to be too early for June rate moves to impact. Industry data points to a solid lift in owner occupier loans in the July month, some of which may be indirect spillover effects of higher rates for investor loans. We expect approvals to be up 1.5% but the focus will be on investor loans.

TD Securities:

- Bankers survey was robust for this month, so we are higher than consensus for this July report.

---

For the AUD, unless there is some shock from the data I am not expecting too much of an immediate currency impact. A miss to the downside should be a negative, it will be read as indicating the construction sector is not maintaining its current role supporting the economy following the mining investment downturn. there will also be a focus on 'investor' loans - the RBA has expressed financial stability concerns due to the weight of lending to investors and have seen macroprudential measures implemented to try and restrain these.