It is a busy economic calendar today with the item of most note Australian home loans

August Home loans m/m,

- expected is 0.5%, prior was 2.9%

Investment lending m/m,

- prior was -3.9%

Owner-occupied loan value m/m,

- prior was 0.9%

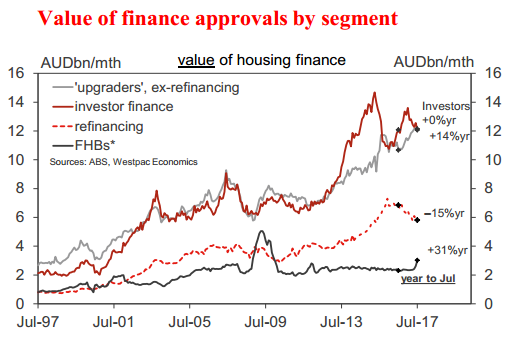

The Reserve Bank of Australia have been concerned on high debt and high house prices. 'Investor loans' is of particular note in this data - the Bank has helped along the introduction of macro prudential tools (through APRA) to slow growth in investment lending. And this has slowed. On the other hand the bank wants to see the building industry and associated sectors continue to add to economic growth.

Preview of today's data via Westpac:

- The number of housing finance approvals to owner occupiers posted another surprisingly strong gain in July up 2.9% and 4.5% ex refinancing. Note that the macro prudential tightening measures introduced in late March and associated increases in rates for investor and 'interest only' loans in March and June have likely given indirect support to owner occupier loan activity. Indeed, the value of investor loans fell 3.9% in July.

- The full impact of these shifts is still coming through. Industry data suggests owner occupier loans were again firm in August but with some signs that the recent lift is levelling out. We expect owner occupier approvals to be flat in the month. The focus will again be on investor loans and to a lesser extent construction-related finance which has shown a notable lift in recent months.