Due at 0030GMT:

- Employment Change expected +20.0K, prior +16.0K

- Unemployment Rate expected 5.5%, prior 5.5%

- Full Time Employment Change prior was -49.8K

- Part Time Employment Change prior was +65.9K

- Participation Rate expected is 65.6%, prior was 65.6%

I posted earlier previews here:

A few more now (bolding mine):

Barclays:

- We expect employment to remain robust, but the unemployment rate is likely to be steady amid elevated participation rates.

Westpac:

Australia posted a 16k increase in employment in January 2018 which records the longest streak of job gains with a 16th consecutive positive print.

- However, the composition of employment changes was quite stark with full-time employment down 49.8k and part-time employment up 65.9k. That comes after a strong 2017 for full-time employment growth and the annual growth rate is still an elevated 3.6%.

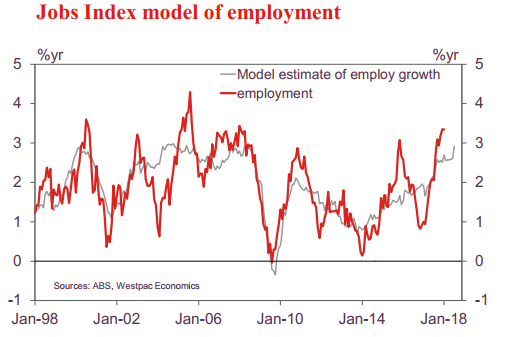

- The leading indicators, both from business and household surveys, have strengthened so far in 2018. Westpac's Jobs Index is suggesting that while employment growth maybe stronger than you would expect, there is no reason to be looking for a fundamental correction anytime soon.

More from Westpac, on unemployment:

- In January, the unemployment rate fell to 5.5% from 5.6% in December (revised up from 5.5%) with participation declining to 65.6% from 65.7%. Over the past year, while the unemployment rate did fall from a peak of 5.9% in February 2017 to the current 5.5%, the drop was more muted than the gain in employment due to rising participation. The uplift in participation has been driven mainly by females joining, re-joining, or remaining for longer in the labour force. However, this spike occurred alongside a rising male participation rate which had otherwise been in a downtrend. Given there appears to be a strong cyclical lift in participation, corresponding to the rise in employment, we are forecasting participation to rise modestly to 65.7% and this will be enough to see the unemployment rate hold flat at 5.5%.

NAB:

- Labour market conditions are a key signpost for the RBA's policy setting

- Markets expect the upcoming jobs data to be consistent with the RBA's "improving, but gradually" outlook

- NAB is also expecting unchanged unemployment rate, but for jobs growth to be much softer (+8k), and the participation rate to soften a touch (65.5%). The NAB survey employment sub-index suggests that employment growth should be running at around 27k per month. This is well below the average growth of around 35k we've seen over the past 12 months, and we are expecting the ABS measure to show softer jobs growth this year. Taken alongside our internal leading indicators, which have been much softer this month, we are looking for a below-market jobs growth of +8k.