I posted earlier: Australian Retail Sales data due today - previews (and expected AUD impact)

More now:

Westpac:

On September data

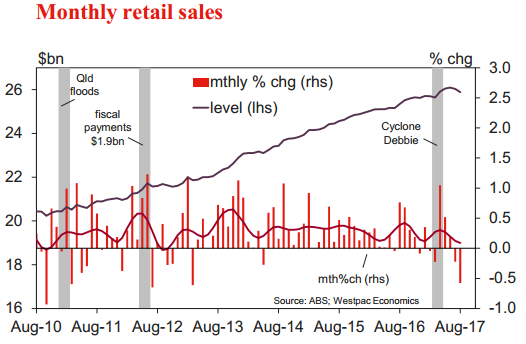

- Retail sales came in well below expectations in August recording a 0.6% contraction with July's flat result revised down to a 0.2% dip. Annual growth slowed to 2.1%, the weakest pace since June 2013. The 0.8% contraction over Jul-Aug is the largest 2mth decline since October 2010, near the tail-end of the RBA's 2009-10 tightening cycle.

- Consumer sentiment lifted in Sep-Oct, although pressures on family finances remained evident. Some drags, from higher mortgage rates and electricity prices, likely eased a touch and job gains remain strong but weak wages growth and concerns about potential rate increases and slowing housing markets are still clear negatives. Retailers are bearing the brunt of the spending slowdown and engaged in aggressive price discounting at the same time. We expect a better but still weak 0.3% gain for September

On Q3 data (excl inflation)

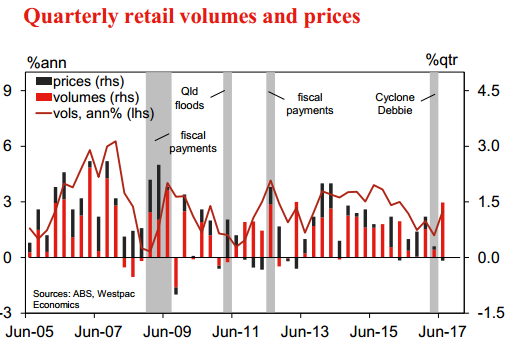

- The last four quarters have been very choppy for real retail sales, a flat Q3 last year, sales followed by a decent 0.8% bounce in Q4, another abrupt slowing as weather conditions impacted in Q1 (+0.2%) and a stronger gain in Q2 (+1.5%). At 2.5%yr, annual growth has slowed overall and is weak by longer term historical standards.

- The Q3 update will show another abrupt slowing with volumes expected to be down slightly in outright terms (-0.1%qtr). Nominal sales are on track to be down 0.2%qtr. The CPI detail suggests about half of this is due to aggressive discounting, food prices alone down 0.9%qtr (this segment accounts for 40% of retail). Note that the retail measure remains an imperfect guide to the broader spending estimates in the national accounts - although the direction for Q3 looks accurate.

TD Securities:

- TD and the market look for a small recovery in retail sales after consecutive falls, the latter attributed to a pause in spending as utility bills jumped in July/Aug. Even with a small rebound in September, it is too late to save retail sales volumes, and most analysts look for no growth in the quarter.

HSBC:

- After showing considerable strength in Q2, nominal retail sales had a rocky start to the third quarter, falling in both July and August. Even assuming a solid lift in September sales, nominal spending would only be flat for the quarter as a whole. With retail price inflation remaining soft (food prices fell sharply in the Q3 CPI data), sales volumes are expected to be roughly flat.

--

Bolding above is mine. that big nit bolded from WPAC is good summation of the sector as it stands.