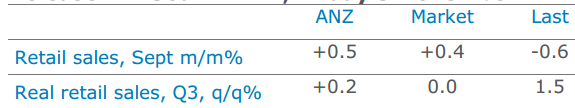

Australian retails sales data for September

- expected +0.4% m/m, prior -0.6%

Also, due at the same time Q3 retail sales excluding inflation

- expected 0.0%, prior +1.5% q/q

Previews via ...

ANZ

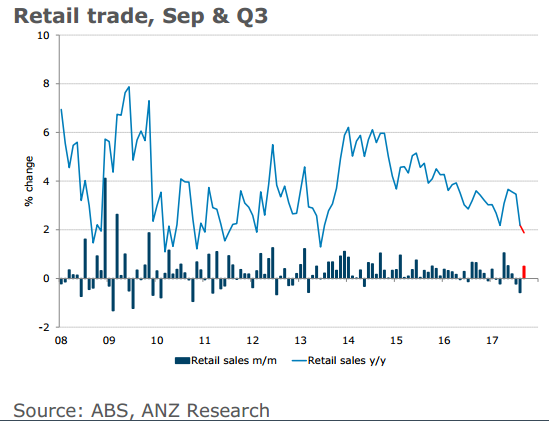

- We expect monthly retail sales bounced back somewhat from recent weakness, rising by 0.5% m/m in September.

- While we continue to see the retail sector facing challenging conditions, three consecutive negative monthly reads is unheard of.

- Q3 CPI data suggest that retail inflation remains very weak, and in fact we think retail prices fell in the quarter. So, our pick is for retail volumes to have risen by 0.2% q/q, well down on the 1.5% q/q rise in Q2 but a bit stronger than Q1's result.

CBA:

We think the quarterly retail trade data will be soft given that sales fell in July and August and were probably soft in September as well.

And, more from CBA ....

- AUD faces some headwinds today because we expect a disappointing Australian retail sales report

- We anticipate a soft 0.3% rise in September retail sales (consensus: 0.4%).

- There looks to have been some discounting in Q3. In real terms, we think retail trade will post a small 0.1% fall in Q3 (consensus: 0%).

NAB:

- NAB's own Cashless Index predicted last month's read and this month it is predicting a 0.6% m/m rise. We have moderated this to a 0.5% increase in our forecasts given the potential for last quarter's number to be revised higher.

- As for the quarterly volumes measure that feeds into GDP, this past quarter has overall been a flatter quarter for retailers and combined with the retail-related CPI prices, estimates point to a marginal 0.1% rise in volumes for the quarter.

Bolding in the above is mine....