ICYMI, the Bank of England left policy unchanged, the chaps overnight were all over it:

- BOE MPC leave rates and QE on hold, vote remains at 6-2

- UK quarterly inflation report

- Pound falls as BOE keeps rates on hold and lowers CPI/GDP forecasts

- BOE's Carney: Monetary policy can not prevent the weaker real incomes likely to accompany Brexit

- Carney says slowing of UK economic potential could have monetary policy consequences

- More from Carney: Will not tie hands of MPC on timing of first rate hike

- Carney: There has been no discussion on raising rates in increments of less than 0.25%

- Would the real Mark Carney please stand up?

- Reactions: The BOE is now leaning more to the dovish side

That final post listed contains an in brief summary from Barclays, more now (bolding mine):

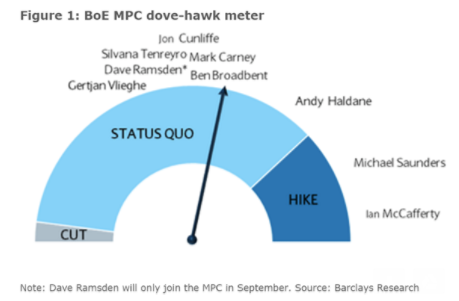

- The Bank of England MPC left monetary policy unchanged at the August meeting, as we and consensus had expected. The vote was split once again with Saunders and McCafferty maintaining their votes for a hike. Macroeconomic forecasts were downgraded to reflect downside surprises in data. Our initial take is that the MPC is now more in line with economic data published in the first half of this year. We maintain our view of no change over the next two years.

- The Bank Rate was left unchanged at 0.25%. This was widely expected: 52 out of 54 economists surveyed by Bloomberg last week (week ending 28 July 2017), including us, expected no change. Markets, too, were not expecting a change.

- The vote regarding the stock of the Asset Purchase Facility programme was unanimous at 8-0 for the status quo and accordingly it was left unchanged at £435bn for UK gilts and £10bn for non-financial GBP investment-grade corporate bonds.

- The Bank confirmed it would reinvest cash flows associated with redemptions in its APF and maintain the stock at the target levels.

- Regarding the TFS, the MPC confirmed that the drawdown period would end in February 2018 as originally envisaged.

- Finally, the Bank revised down its growth forecast for this year from 1.9% to 1.7%, somewhat exceeding the downside surprise in data. That likely reflects a marginally more cautious assessment in particular regarding investment. Inflation was revised only marginally lower this year, and unchanged thereafter. The rhetoric regarding the future path of interest rates remains largely unchanged.

- Overall, we believe the MPC is leaning somewhat more on the dovish side in August after surprising with some hawkish statements by MPC members previously. In our view, this is now much more in line with underlying data and reduces the risks of a early take-off in the Bank rate despite the Bank still being willing to maintain an upwards slope in rate expectations.