Barclays FICC research department out with a note 23 June

Courtesy of our friends at Finance Magnates.

Waiver from Barclays: This author, Marvin Barth, is a member of the FICC Research department who is not subject to all of the independence and disclosure standards applicable to analysts who produce retail debt research reports under US FINRA Rule 2242.

Make of it all what you will.

USD:

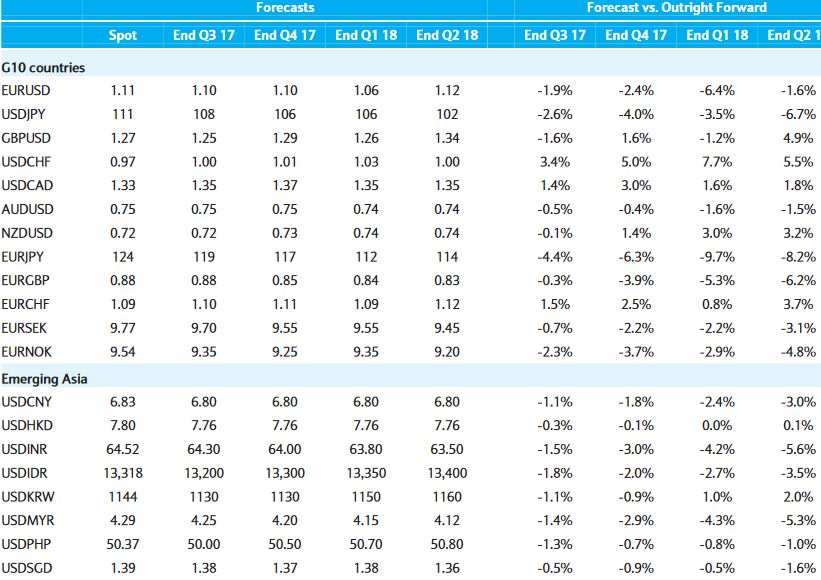

We expect USD to remain range-bound as modest tax cuts and the Fed's passive balance sheet reduction create mildly supportive conditions for the USD into Q4. Fed's balance sheet normalization later this year should induce a muted reaction as its signalling effect would be weak amidst a hiking cycle, modest increase in UST term premia and stable risk appetite supported by global growth.

We believe the USD's advantage from a returns-to-capital perspective has been eroded by stronger growth trends in the rest of the world. Without a substantial policy boost that includes tax reforms, we see the current multi-year USD rally as close to an end.

EUR:

We expect EURUSD to range trade for the remainder of the year as European political risks have eased and the ECB seems committed to a slow pace of policy normalization. Political uncertainty is likely to return early next year around the Italian election, a time where the USD may see greater support from expansionary fiscal policy and higher US interest rates.

JPY:

The supportive environment for USDJPY, including a sharp recovery in global cyclical momentum and reflationary expectations that drove global yields and equities higher, has continued to fade since early 2017. Although we postponed our expectations for the BoJ's10y hike to Q3 18, we think the USDJPY should remain driven by global dynamics.

Hence, we expect USDJPY to gradually decline to sub-110 in the quarters ahead given extended undervaluation of the JPY despite Japan's closing output gap, large current account surplus, and Japanese investors turning more cautious towards foreign investment.

GBP:

The outcome of the UK general election has created challenges for Brexit negotiations and risks of no deal now look significantly higher. We expect the maximum uncertainty to bite in the coming quarters, with EURGBP ending the year at 0.85. From there, reduction in prevailing undervaluation and increased clarity around the negotiations support GBP appreciation, bringing EURGBP to 0.83 in Q2 18

CHF:

With the ECB cautiously moving ahead with normalization, monetary policy divergence versus an on-hold SNB will likely support our view of additional, albeit only modest, EURCHF appreciation, as SNB policy remains unchanged. We forecast EURCHF at 1.11 by year-end and 1.12 by Q2 18

CAD:

We remain bearish CAD in the medium term. The recent hawkish shift by the BoC is unlikely to be met by rate hikes this year given the macroeconomic backdrop. We see the USD topping out by year-end, supported by potential tax cuts, and forecast USDCAD to reach 1.37 in Q4 17. In 2018, expectations of a BoC hiking cycle should support the currency, but the end to OPEC's production cuts, the risk of protectionist measures and modestly slowing activity in the US could limit CAD strength.

AUD:

We see a broadly flat to mild downward trend in AUDUSD, and expect the AUD to underperform other major currencies such as the NZD. Although improving domestic fundamentals and a less dovish RBA should provide support for the AUD, external factors are likely less favorable. China's plans to curb property speculation and informal sector credit growth, as well as its plans to rebalance the economy away from investment, could mean that any rebound in commodity prices is unlikely to be sustainable given excess production capacity.

Our commodity analysts forecast China-sensitive commodity prices will remain suppressed over the next year. The Australia-US yield differential would likely continue to narrow in 2017, taking into consideration our forecast of one more Fed rate hike this year while the RBA remains on hold, although our expectation of RBA starting a hiking cycle in May 2018 could help provide some support for the AUDUSD next year

NZD:

We see the NZD outperforming the AUD. NZD has performed well despite RBNZ trying to dampen expectations of an early rate rise. Strong net permanent and long-term migration is helping to support domestic activity and lift business sentiment, but also adding to labour supply and dampening wage pressures. Core inflation and inflation expectations have picked up from low levels, although they may be driven by temporary factors.

Dairy prices have been moving up of late, and we do not expect a sharp fall in prices to the lows of 2015. Policy uncertainty for the country is set to rise, with a general election scheduled for September 2017 and RBNZ Governor Wheeler stepping down in the same month. However, with New Zealand having one of the most positive output gaps among G10 peers, RBNZ may not be able to keep rates low for long. If the RBNZ were to raise rates faster than expected in 2018, the NZD could outperform.

CNY:

The change in formulation in the CNY fixing has dealt a blow to CNY bears. Assuming that there is a desire to maintain stability in the NEER and curb market CNY depreciation expectations, CNY direction will be dependent on USD gyrations. In this respect, wethink the USD is close to a top and will likely range trade over the summer.

Consequently this implies that USDCNY will also be stable over the coming months as reflected in our new forecasts. We think China will continue this policy following the Party Congress. Gradually slower growth and slow deleveraging are likely, leaving both the CNY and other Asian currencies unperturbed.