The data focus from the US will be on inflation, but just to kick off some previews, beginning with retail sales

- Data due at 1330 GMT (as is US CPI)

Previews via:

Capital Economics:

- After surging at the end of last year, headline retail sales probably fell in January, as auto sales declined and underlying retail sales only held steady.

- The 5% rise in seasonally adjusted gasoline prices will translate to a 3% gain in gasoline store sale values.

- But other components are unlikely to fare as well. The drop in automakers' sales last month is consistent with a 2% drop in retail auto sales.

- Excluding autos, gasoline and building materials, control group retail sales surged by an unsustainable 9.8% in the fourth quarter. They are now well above their previous trend, so we wouldn't be surprised if they held steady or even declined in January.

- Overall, that would translate into a small 0.1% drop in headline retail sales in January. But that would not be too much of a disappointment following the surge in retail sales in the fourth quarter, and would still leave the y/y growth rate at a healthy 4.6%

Barclays:

- We forecast retail sales to have increased 0.3% m/m in January.

- Manufacturers' reports released earlier this month showed that vehicle sales slowed in January, and we expect a similar move in the retail sales data. On the other hand, gasoline prices indicate a sharp increase in gas station sales. For sales excluding motor vehicles, we forecast a 0.8% increase.

- Excluding volatile items such as autos, gasoline stations, food services, and building materials, we expect retail sales to be up 0.5% m/m.

Nomura:

- We forecast a healthy 0.5% m-o-m increase in core ("control") retail sales in January.

- Survey indicators suggest healthy business activity in the month. The ISM non-manufacturing index rose notably to 59.8, above markets' expectations. The report also indicated strong expansion in new orders and business activity. We think core retail sales will reflect this vigor.

- Among non-core components, we expect a notable boost from sales at gasoline stations. Retail gasoline prices likely increased strongly in the month, which should boost nominal sales at gasoline stations.

- Further, we expect a slowdown in sales at autos and auto parts dealerships from the prior month. If realized, this would be consistent with the slowdown in light vehicle sales in January from the pace in December, as reported by WardsAuto.

- Excluding auto sales, we forecast a 0.8% m-o-m increase in retail sales. Altogether, we expect a 0.4% m-o-m increase in total retail sales.

Westpac:

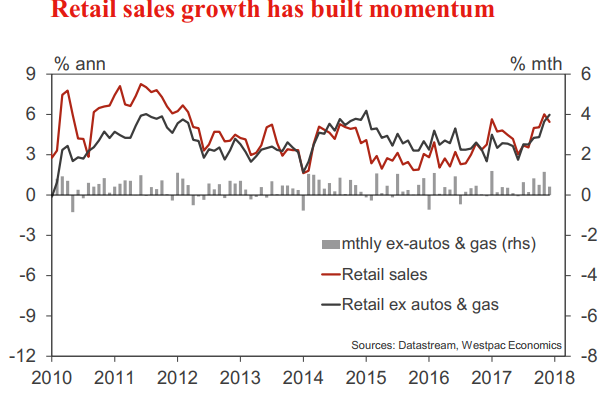

- Retail sales growth accelerated in late 2018. This was partly due to hurricane damage in Texas and surrounding states (which created a need to replace cars and other durable goods).

- Energy prices were also supportive of nominal spending over the period. That said, underlying demand is also robust and broad based. Indeed, the December report included an upward revision to core sales in November.

- Another solid headline gain is anticipated in January, 0.4%. This is despite autos acting as a drag and limited support from energy prices. Core sales are likely to have risen by 0.5% in the month.

Pantheon Eco:

- Total sales will be depressed by the drop in auto sales as the post-hurricane surge faded, partly offset by the impact of higher gasoline prices.

- Total sales should rise just 0.1%, with sales ex-autos up 0.3%. The control measure should rise 0.2%.

- Consensus: Total sales 0.3%, ex-autos 0.4%, control 0.4%.

---

Long live cryptocurrencies? Five insights from the ASAC Fund