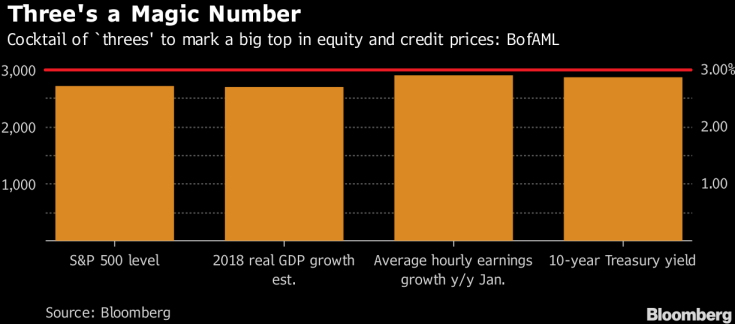

Bank of America Merrill Lynch makes a case that a top in equity and credit prices may soon come

And that cocktail consists of real GDP forecasts, wage inflation, and US 10-year yields touching 3%; along with the S&P 500 index rising above 3,000.

"Bullish investor positioning, peaking corporate profits and monetary policy tightening should result in the bevy of "threes"," strategists at the bank argues - from a client note.

They add that "further wage growth acceleration is negative for bonds and equities and if tech stocks can't make new highs in the next week or two then market highs could be seen as having been reached for the next couple of months".

They also add that their favourite long trade for the year remains volatility and that their favourite short trade for the year will be in credit.

Though they do point out that the credit market is key for the current rally to extend further, saying that a fresh weakness in corporate bond spreads will be negative for all risk assets.

Well, we could be in for an early treat of that this month where we will get the US jobs report next week as well as the FOMC meeting that is to come on 20-21 March. And you wouldn't bet against either having little to no impact on yields as well.