There is plenty of data due from the US on Wednesday, including retail sales at 1230GMT

Some bank previews & one not (bolding mine) ... quite a disparate set of expectations:

Barclays:

- We forecast retail sales to have increased 0.3% m/m in February.

- Manufacturers' reports released earlier this month showed a modest slowing in vehicle sales, and we expect a similar trend to be reflected in the retail sales report. Gasoline prices have come off since January and suggest a decline in gas station sales.

- For sales excluding motor vehicles, we forecast a 0.4% increase. Excluding volatile items such as autos, gasoline stations, food services and building materials, we expect retail sales to be up 0.3% m⁄m.

Commerzbank:

- We anticipate a large gain of 0.5% in retail sales in February (consensus: 0.3%). This is all the more remarkable as gasoline prices have fallen slightly according to our seasonal adjustment, and so nominal sales at the gas pump have probably declined.

- Above all, we expect a sharp increase in sales at restaurants and building material sales, where business had suffered from the bad weather in January.

& Capital Economics

- We expect a muted 0.1% m/m rebound in retail sales in February, following the 0.3% m/m fall in January.

- The contraction in January was partly due to a drop back in motor vehicle sales. The post-hurricane surge in sales to replace the 300,000 plus vehicles destroyed has faded. The manufacturers' unit sales data point to a further modest fall in February. In addition, gasoline prices fell back slightly, which will drag down the value of gasoline station sales.

- On the upside, the weather-related 2.4% m/m drop in building materials sales in January should be reversed.

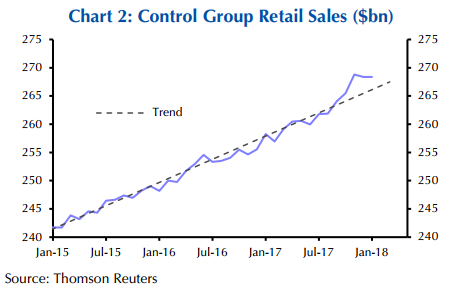

- Excluding those components, we have pencilled in a 0.3% m/m gain, after sales were unchanged in January. Although the level of control group sales is above trend, consumer confidence is very high and last month is when households began to see the tax cuts show up in their pay cheques. (See Chart 2.) The one-off bonus payments announced by many firms may have provided a boost to spending too. Finally, the flu epidemic began to fade, particularly in the second half of February, which is another reason to expect a better month for underlying sales.