WSJ reports that business lobbyists are pushing to repeal the alternative minimum tax (AMT) after the Senate's last-minute move to keep it alive

The corporate AMT is a parallel system with low rates and fewer breaks that kicks in if a variety of tax breaks bring a firm's regular tax bill too low. Currently, the corporate AMT of 20% rarely applies, since most corporations face a higher 35% tax rate and benefit from breaks eligible under both systems.

With a proposed 20% corporate rate, many companies could end up in the AMT-and lose some of their tax breaks in the process.

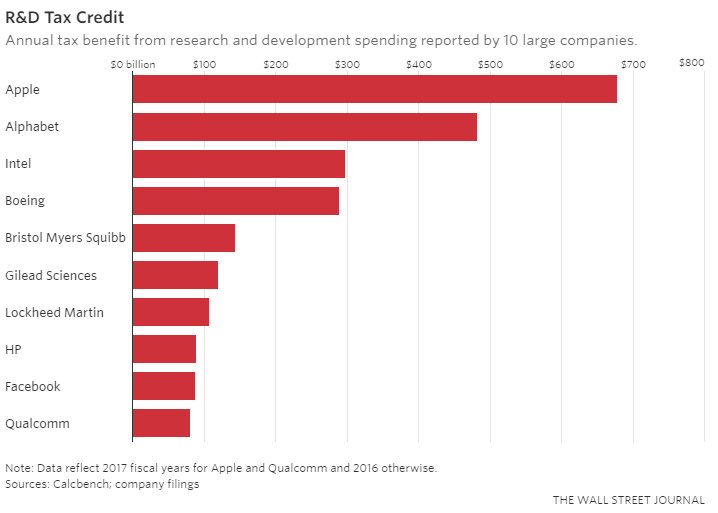

Tech companies are saying that keeping the AMT would make it harder for them to claim tax credits for R&D spending. Meanwhile, banks are arguing the case that it would be difficult to claim credits for investing in troubled US areas.

The article goes on to say that among S&P500 companies reporting $3.1 billion in tax benefits from the credit in 2016, 85% went to 20 corporations, mostly in the tech, pharmaceutical, and defense sectors - citing Calcbench as its source.

The House tax bill which was passed on 16 Nov eliminated the AMT and earlier drafts of the Senate tax bill did the same as well.

A potential debate in the works? Remember, the House and the Senate are trying to reconcile competing versions of the tax overhaul and hopefully reach an agreement to pass the final bill before Christmas. We'll have to wait and see if this is one of the items on the agenda that both parties agree or disagree upon.