Credit Suisse is arguing that the current account deficit is making a comeback as a reason to sell some Asian currencies such as the IDR and INR

While an all out trade war is not breaking out (just yet), the recent tariffs from the US has put pressure on Asian currencies over the last two weeks.

And according to Trang Thuy Le, a macro strategy analyst in Credit Suisse Hong Kong, the recent trade rhetoric has put the spotlight on countries needing to funds to narrow their deficits - and that makes their respective currencies vulnerable to outflows when investors shy away from risk assets in the region.

"Deficit currencies such as Indonesia's rupiah, India's rupee and the Philippine peso are likely to be more vulnerable just because they need funding for their current account deficits, and the environment is not supportive for portfolio flows. India and Indonesia also have had large inflows into their respective markets recently so they are at risk of a reversal", Trang argues.

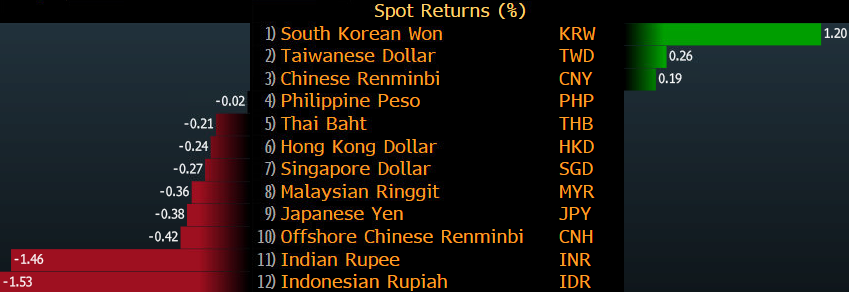

Here's a look at how Asian currencies have performed against the dollar since mid-February: