The Governing Council of the European Central Bank meet Thursday this week

RBC preview what to expect

We don't expect the ECB to announce any major changes at its first meeting of 2018.

- That is despite the account of its December meeting saying that the ECB would make changes to its forward guidance 'in coming months'.

However ... changes to the language are coming even if it's difficult to pinpoint when.

- With the euro area economy humming along nicely and the threat of deflation having passed, the easing bias implied by elements of the current language seems increasingly obsolete.

- But, one crucial line in the accounts was that changes to the guidance would include what is currently said on the sequencing of policy changes.

For that reason, we restate our current ECB call; we expect QE to continue to September as currently planned with a short taper of three months then taking purchases to the end of 2018 and rate rises coming only 'well' after that point, we think in Q3 2019.

Also, this via Deutsche - they are expecting on hold at this meeting ... but:

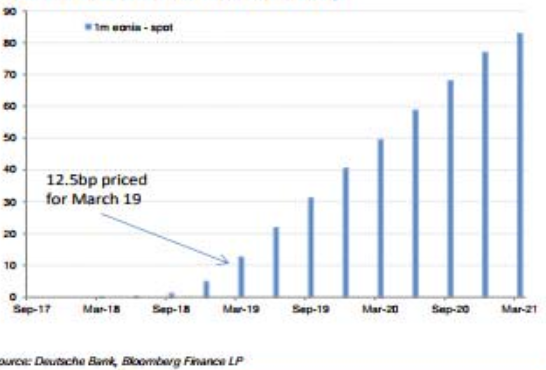

- Market is pricing a 50% joint probability that the ECB ends QE in September

- "well past" equates 6 months and the first hike is of 25bp