A European Central Bank preview and scenario analysis from ING - this is awesome!

More:

- survey indicators still point to a continuation of the recovery well into 2018

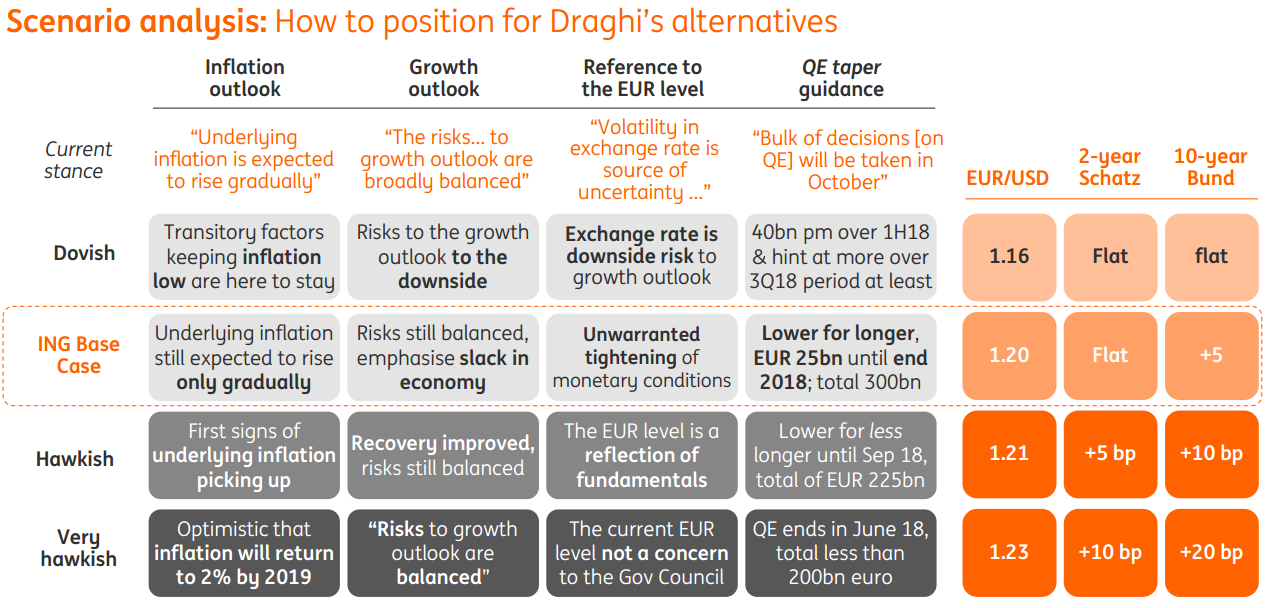

- As inflation (expectations) remain low and clearly below the ECB's preferred 2% level, strong growth will be essential for the ECB to publicly announce details of its tapering of QE for 2018

What this means for markets

FX market: One-off move in EUR/USD higher followed by range trading

- We look for a knee jerk reaction in EUR/USD higher, potentially testing the 1.20 level in response to the expected cut in QE from €60bn to €25bn per month.

- Yet the lower for longer QE anchoring the scale of Bund sell-off and Italian elections in early 2018, suggest only 'one-off' EUR/USD upside.

- We look for the cross to range-trade in coming months and only spike higher in 2Q18 once Italian election risk passes

--

Earlier previews:

- Barclays expect President Draghi to announce a nine-month extension of the APP at a lower pace of EUR30bn per month

- Morgan Stanley outlook for the ECB meeting this week and BoE next

- UBS on what to expect from the ECB this week

and