Bloomberg's survey of economists from 23-28 February shows

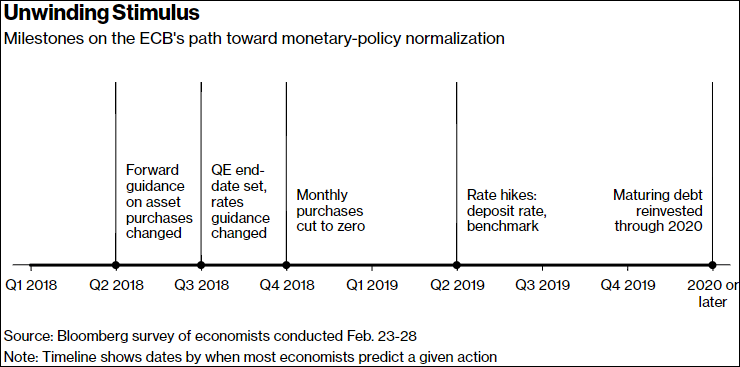

The survey respondents see the ECB changing its message on asset purchases by June, and to set an end date for QE by July instead.

Meanwhile, they forecast that the ECB will tweak guidance with regards to interest rates only in September, in which respondents said they don't see a change in interest rates until "well past" the end of the QE programme.

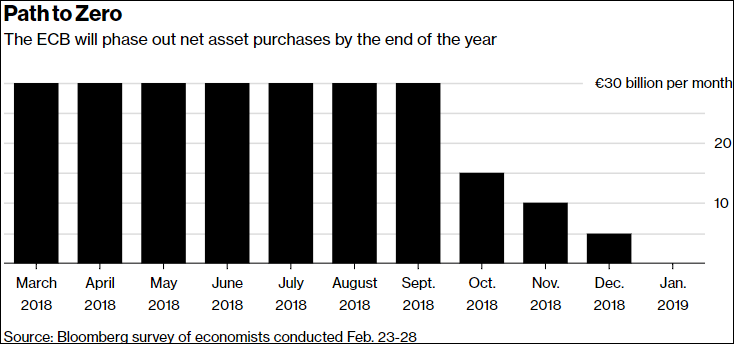

The current forecast is for the ECB to wind down its QE programme by January 2019:

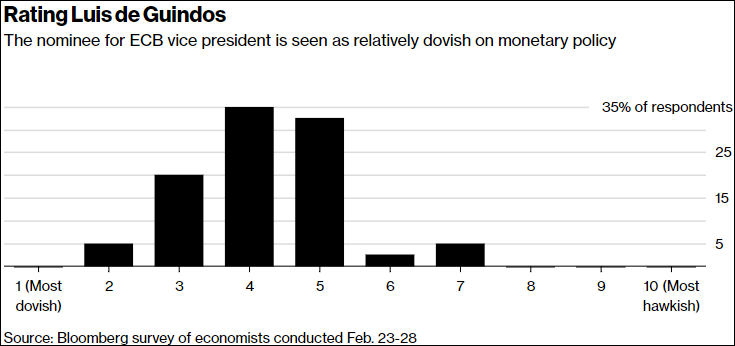

Meanwhile, respondents were not sure of what to make about impending ECB vice president Luis de Guindos, rating him as dovish-neutral in terms of his monetary policy stance:

The ECB will be announcing the decision of its monetary policy meeting later this week on 8 March. But they're not the only central bank on the agenda this week. You can check out the rest in this post here.