Correlations have broken down

The old bet on Japanese equities always involved hedging away the currency risk. That's because there's a decades-old correlation between a falling yen and rising Japanese stock markets.

Lately, though, that correlation has reversed. The Nikkei 225 was one of the world's best performing markets last year even as the yen rallied.

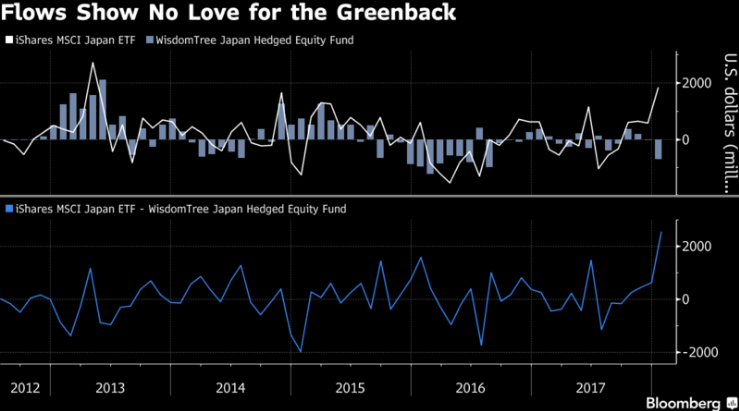

Instead of betting on a reversion, market participants now appear to be betting on more of the same. Bloomberg writes about how Japan ETFs that take the FX risk are suddenly much more popular than hedged options.