Major indices end higher. 10 year yields in Europe are lower

The major European stock indices ignored the US developments today, and staged a rebound.

- German DAX is closing up 1.1%

- France's CAC is up 0.4%

- UK's FTSE is up 0.2%

- Spain Ibex is up 0.4%

- Italy's FTSE MIB is up 1.22%

- Portugal's PSI 20 bucked the trend and is closing down -0.12%

In the 10 year debt sector yields are lower today:

- Germany 0.66%, -1.5 basis points

- France 0.904%, -2.4 basis points

- UK 1.506%, -1.5 basis points

- Spain 1.452%, -3.9 basis points

- Italy 1.957%, -4.0 basis points

- Portugal 1.864%, -5.3 basis points

In other markets as London/European traders look to exit:

- Spot gold is down $10.60 or -0.79% in $1324

- WTI crude oil futures are trading down $.64 or -1.02% at $61.96. The DOEs inventory data showed a lower-than-expected build in inventories today. After a run higher to a high of $62.58, the price has since settled down above and below the $62 level

- Bitcoin is trading sharply lower today. It is down $900 to $9888. It is trading at session low. The price of the digital currency fell below its 200 hour moving average yesterday (currently at $10,980) and moves toward the 38.2% retracement of the move up from the February 6 low at $9520 (see chart below)

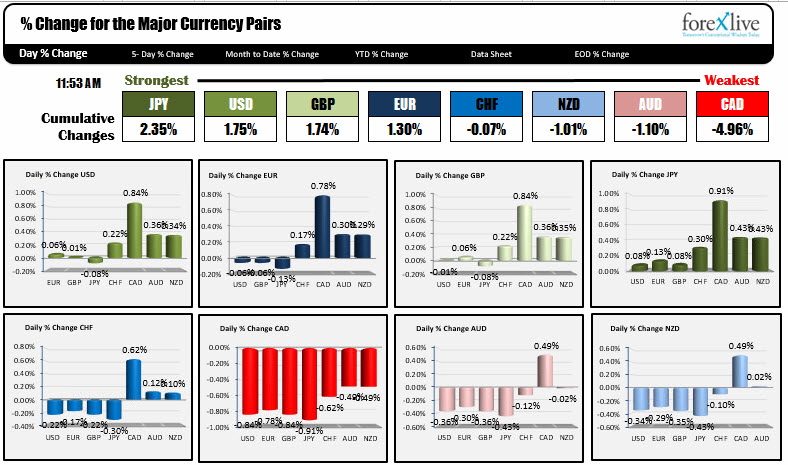

In the forex market, the JPY remains the strongest, while the CAD, AUD and NZD remain the weakest. The USD has moved higher, mainly on the back of the risk off trade in the commodity currencies.

US stocks recovered off a lower opening but is moving back lower now.

- The S&P index is down 16.6 points or -0.61% at 2711.70

- The NASDAQ composite index is down 23.5 points or -0.32% at 7347.28

- The Dow industrial average is down 243 points or -0.99% at 24637.96

US yields are lower trading midrange for the day.

- two-year 2.2458%, -0.4 basis points

- 5 year 2.63%, -2.6 basis points

- 10 year 2.859%, -2.7 basis points

- 30 year 3.134%, -1.9 basis points