German Dax leads the declines

The German Dax fell by -1.6% for the day and is down -4% for the week. That index has the dubious distinction of being the weakest of the major European indexes today/this week.

Here is the summary:

- German DAX -1.6% and -4.0% for the week

- France's CAC -1.2% and -3.3% for the week

- UK's FTSE -0.3% and -3.2% for the week

- Spain's Ibex -1.2% and -3.8% for the week

- Italy's FTSE MIB -0.49% and -2.4% for the week

- Portugal's PSI20-0.4% and-1.6% for the week

For the year, the declines are getting a bit hefty:

- Germany, -7.98%

- France, -3.9%

- UK, -9.87%

- Spain, -6.39%

- Italy has bucked the trend with a gain of 2.24% in 2018.

- Portugal, -0.68%

In the European 10 year debt sector:

- Germany 0.528%, unchanged

- France 0.759%, -1.0 basis points

- UK 1.448%, +0.8 basis points

- Spain 1.267%, -2.6 basis points

- Italy 1.876%, -1.1 basis points

- Portugal 1.721%, -3.3 basis points

In other markets as London European traders look to exit:

- Spot gold plus $20.62 or 1.55% at $1349.64

- WTI crude oil futures plus $1.09 or 1.7% at $65.37

- bitcoin is trading up $18 at $8610. It remains below its 100 hour moving average at $8700 in NY/London trading.

US stocks continue to struggle:

- S&P index -14.8 points or -0.57%

- NASDAQ -61 points or -0.85%

- Dow Jones industrial average -68 points or -0.28%

US yields are trading near unchanged:

- two-year 2.266%, -1.2 basis points

- five-year 2.618%, -0.5 basis points

- 10 year 2.828%, +0.4 basis points

- 30 year 3.070%, +0.8 basis points

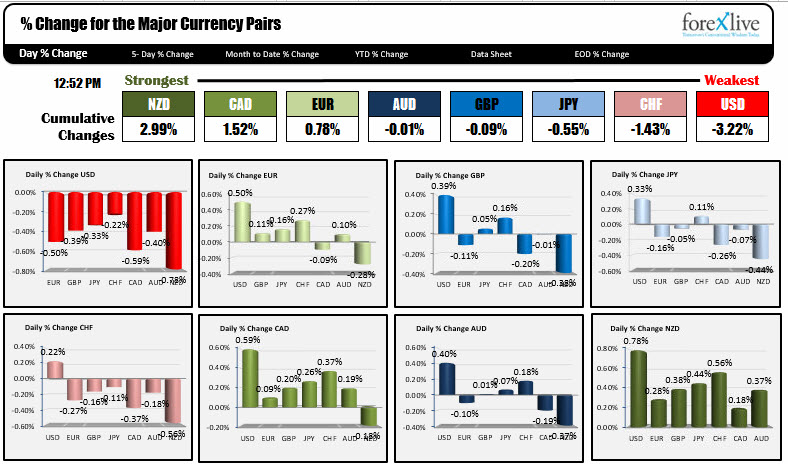

IN the forex market, the USD remains the weakest currency for the day (and got weaker in the NY morning session). The NZD is the strongest currency.