Bulls a little more in control.

The GBPUSD moved higher in the Asian session. but trades around the mid-range currently.

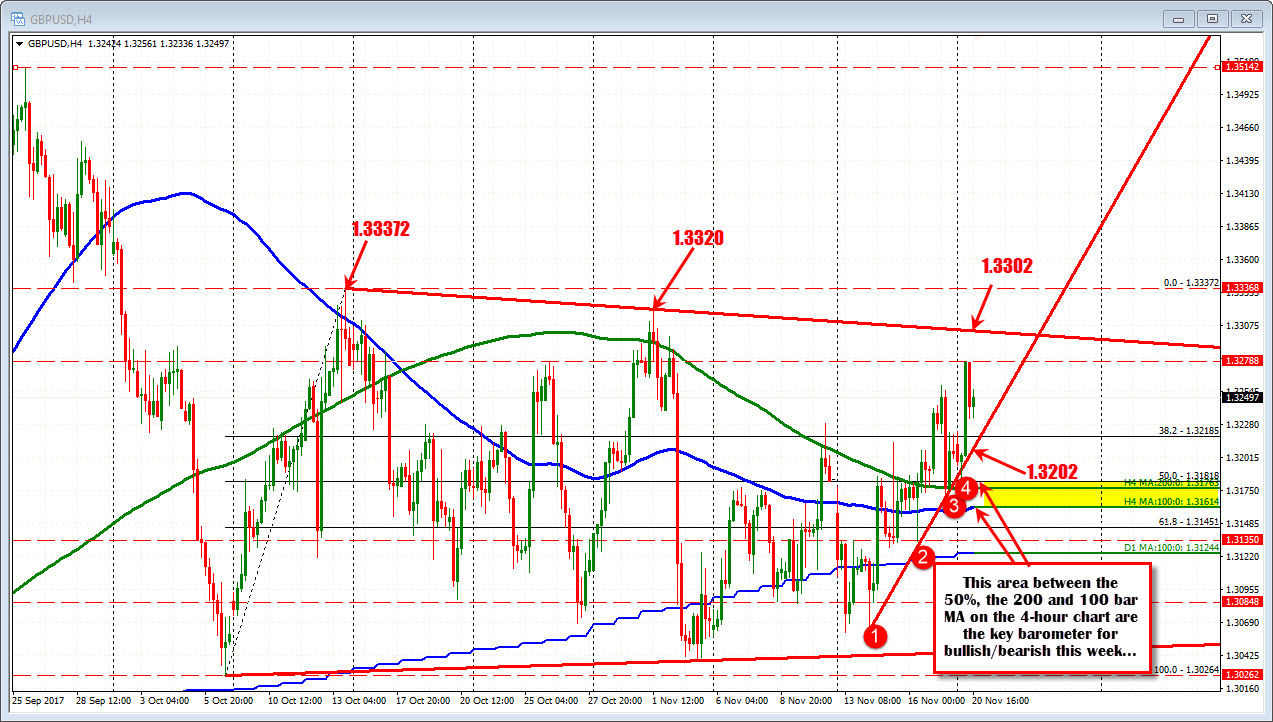

The high today took out the high from last week at 1.3259 and peaked at 1.32785. That was the highest level since November 2nd. It was right on the swing high from October 26th.

That peak against a prior swing high is a bit of a setback for the bulls. It keeps the pair within the confines of the 7-week trading range. The price remains below a topside trend line at 1.3302, and the peaks over the last 7 weeks at 1.3320 and 1.33372. That is the bearish from the chart.

What keeps the pair more bullish is:

- the price is higher on the day.

- The price is above a lower trend line at 1.3202

- The price is above the midpoint of the 50% at 1.31818

- The price is above the 200 bar MA on the 4-hour at 1.3176 and

- Above the 100 bar MA on the 4-hour at 1.31614

Now, with the price trading up and down over the last 7 weeks and within the range, the bias can do another "switcheroo" without much work. It starts by taking out the trend line at 1.3202 and will turn increasingly more bearish as the price dips below the other levels outlined above.

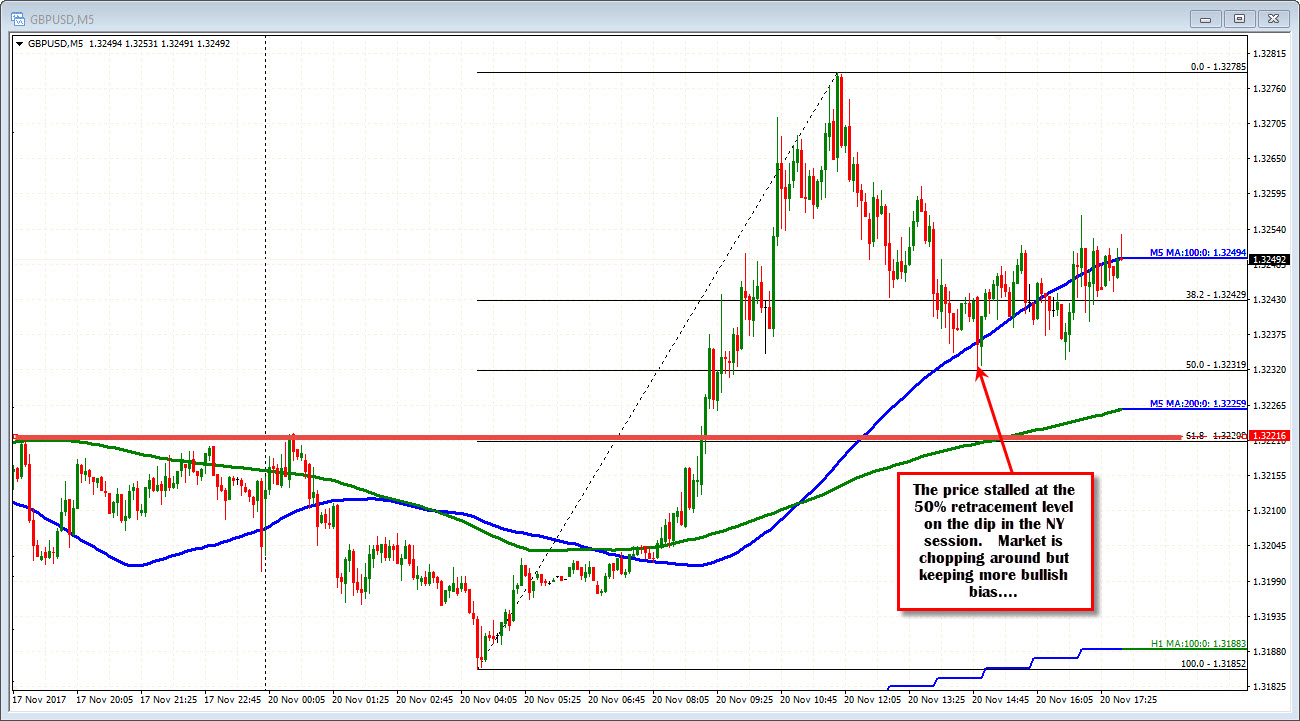

Drilling to the 5-minute chart today, the price took out swing levels from Friday afternoon and the early Asian session at 1.32216 area (bullish). The correction lower has dipped below the 100 bear MA but did stall just ahead of the 50% midpoint at 1.32319 level. The 200 bar MA is moving higher at 1.32259.

Staying above the 50% is more bullish. A move below would not be all that great to see for the buyers.

So buyers are more in control, but the pair remains under overhead levels too. Moreover the up and down nature of the price action over the last 7 weeks suggests the bias can swing around with a little push.

So be nimble. Pick your spots. Listen to the price action.