200 hour MA a key for bias barometer now

The USDJPY has been correcting higher since bottoming on Feb 15th. The move higher took the price to the 100 hour MA (blue line) on Feb 19th and then broke through on Feb 20. Today, the 200 hour MA (green line) was broken in the Asian session. That was more bullish. The price has not been above the 200 hour MA since Feb 8th.

The break, sent the price up to the swing high from Feb 14th at 107.90. The 50% of the move down from the Feb 2nd high was up ahead at 108.008. The price stalled at the 107.90 level and rotated lower.

The price decline has taken the price back to the 200 hour MA. Buyers leaned against the level and bounced. That MA comes in at 107.30. Staying above keeps the buyers against the MA happy (and the buyers from yesterday and the end of last week happy too). A move below, and some of that happiness will go away. We should see more downside.

On the topside, the 107.58 is the underside of the broken trend line. A move above that level would take some of the downside pressure off the pair.

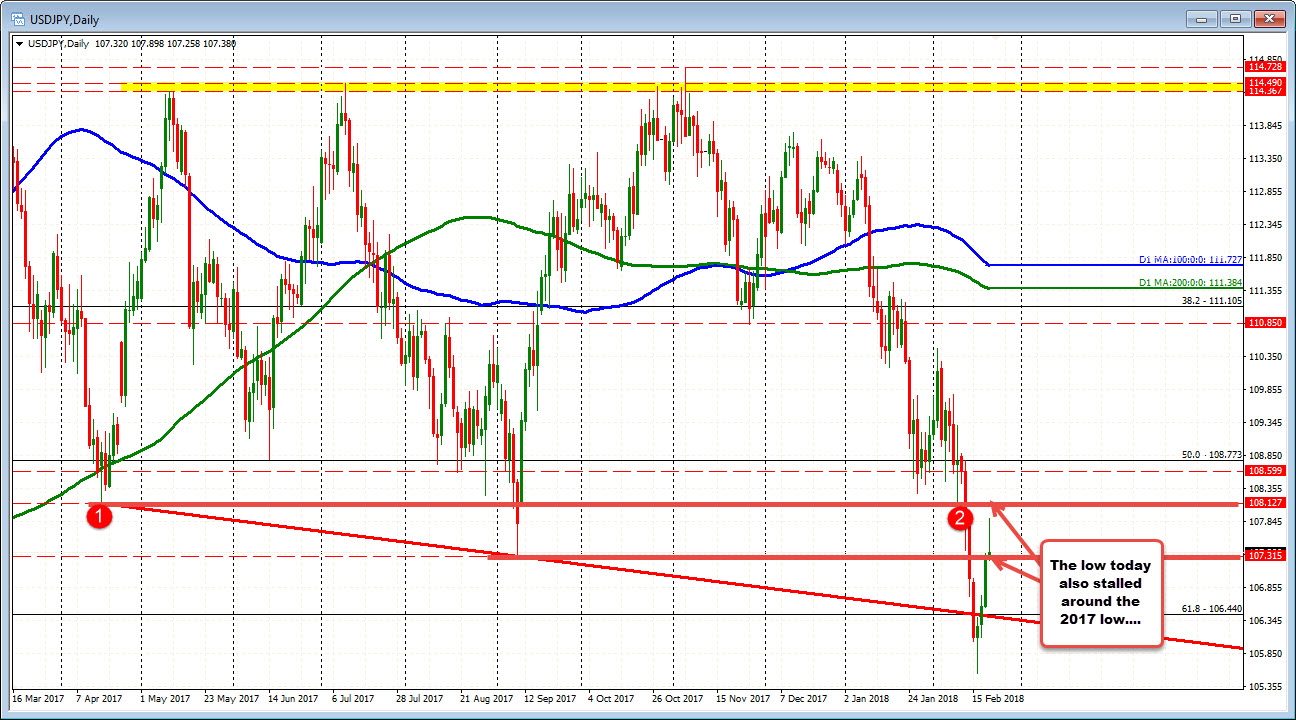

Looking at the daily chart below, the move lower has moved back to re-test the 2017 low price at 107.31. That level - along with the 200 hour MA - makes the area a key support level. Stay above, bullish. Move below, bearish.

US stocks are expected to open a bit mixed.