Forex news for Asia trading on October 25, 2017

- Bank of Canada to be a focus later. The USDCAD stays above the 100 day MA

- US 10 year yield at a key, key level

- Japan to consider expanding tax incentives for firms to encourage higher wages

- Nikkei 225 going for the 17th up day, but gains being eroded

- People’s Bank of China sets yuan reference rate at 6.6322 (vs. yesterday at 6.6268)

- The weaker CPI slowed the AUDNZD a bit. AUDJPY cracking lower.

- Lower CPI send the AUDUSD lower. Tests key swing area.

- Australian CPI for 3Q 0.6% vs. 0.8% estimate. Trimmed mean 0.4% vs 0.5% est.

- Australian skilled vacancies unchanged in September

- Forex technical analysis: USDJPY closes above trend line resistance. Key ceiling.

- Bitcoin technicals: Price breaks below MAs. Turns bias more bearish.

- NZ PM-designate Ardern appoints Grant Robertson finance minister

- Have a trade idea? Enter it here and share the wealth.

- Apparently, the crude oil inventories rose 0.519MM barrels. Gasoline stocks plunged.

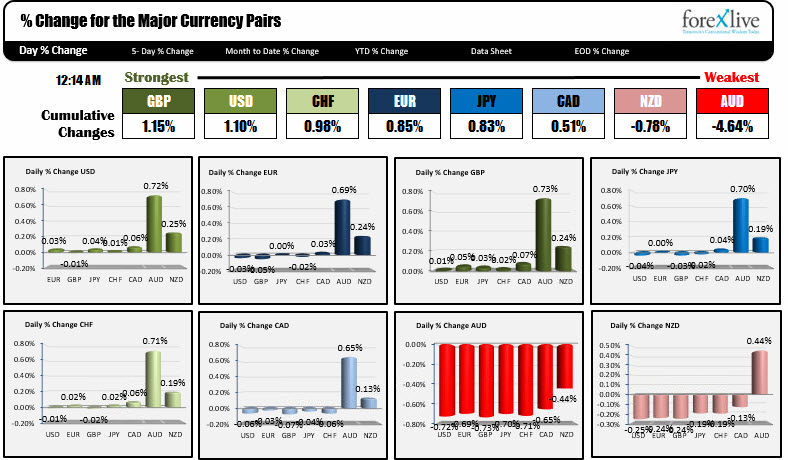

- As the NA session moves toward the close, the EUR is the strongest, the NZD is the weakest.

- Canada's Fin. Minister Morneau: Canada budget deficit seen lower

- US stocks ending the session with gains but off highs

- ForexLive Americas FX news wrap: Trump takes a beating

In other markets, a snapshot shows:

- Spot gold down -$3.88 or -0.30% to $1273.04

- Nikkei 225 is trading up 13 points to 21818. A positive close will be the 17th consecutive higher day (see post here). The Hang Seng index is up 205.62 points or +0.73%.

The price action has been pretty pathetic in the Asian session with the exception of the pair with AUD attached to their name. The Q3 CPI data was released and it came out weaker than expected at 0.6% QoQ for the headline and +0.4% vs 0.5% for the trimmed. Moreover the YoY data was also weaker at 1.8% for the three measures (headline, trimmed and weighted median). The target for the RBA is 2% -3%. Staying below will likely keep the RBA on hold. The AUD pair reacted accordingly.

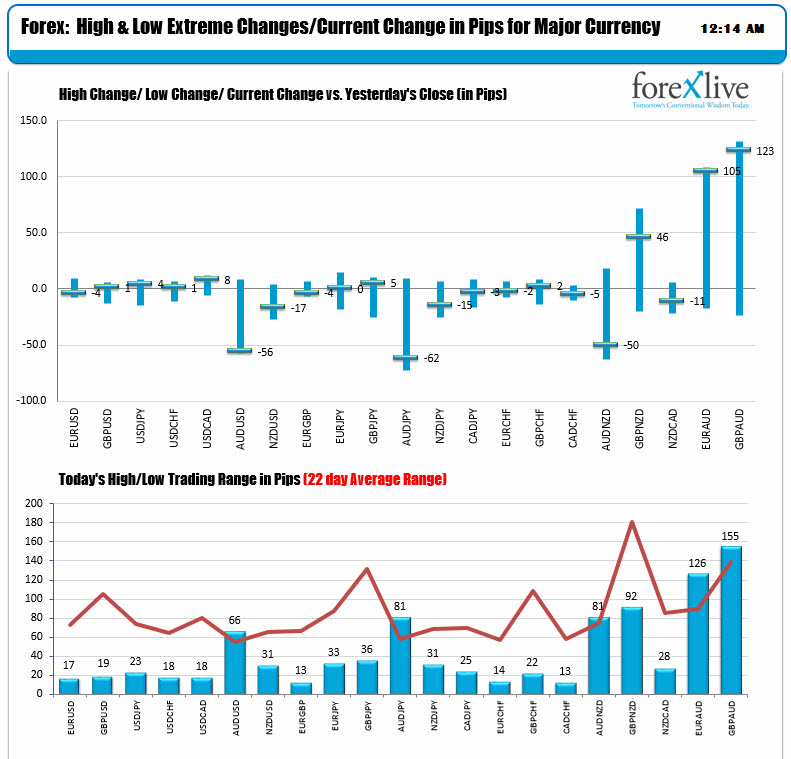

The AUDUSD is trading down -56 pips (see charts above). The range is 66 pips from the low to the high.

By point of comparison,

- the next largest trading range comes in at 23 pips for the USDJPY. It is up 4 pips from the NY close.

- The GBPUSD has a range of 19 pips. It is up 1 pip.

- The EURUSD has a low to high trading range of 17 pips and is down -4 pips on the day.

That is not a lot of meat on the trading bone to say the least (it must be because Eamonn took the day off today).

The good news for traders is if you jumped quickly onto an AUD band wagon, you had the potential to make a few pips as the prices have continued to extremes after the weaker data with limited corrective price action.

For the AUDUSD, the pair has fallen below the 0.7755 level and the 0.77266 support levels now (the 0.77266 is the 50% of the move up from the May low - see post here). Into the European/London session traders will be focused on the 200 day MA at the 0.7692 level as the next key target. Look for buyers on a dip near that level.

The AUDJPY also fell sharply and in the process felll below the 200 hour MA at 88.38, the 50% retracement at 88.156 and has traded above and below the 61.8% of the move up from the October 10 low at 87.94. There are a collection of swing lows that come in around the 87.78 area.

The AUDNZD, which has rising on the back of NZD weakness since the announcement of the coalition government, has even seen some reversal today. It is down -50 pips on the day with a trading range of 81 pips.

The Nikkei 225 is looking to close with gains for the 18th consecutive trading day. It is currently up about 18 points as I type.

Just because the AUD is the one and only star of the day so far, does not mean it will be the star as the Europe and then the North American sessions commence and play out.

In Europe, the UK GDP will be released and in the North American session, the US advanced durable goods data will be released with new home sales and oil inventory data. In Canada, the BOC will announce their statement at 10 AM ET/1400 GMT (see technical preview here).

Below is the snapshot of what the % changes look like as the European session begins.

I am sure Mike will take care of you for the start of the European session. For me, it has been a pleasure serving you in Eamonn's absence. I will be back in the NY session, so it is off to bed for me. Good fortune with your trading.