Forex news for the European morning trading session 26 Oct 2017

News:

- ECB Preview - Is this the end of QE ?

- All the ECB previews in the one place

- UK legislation for withdrawal from EU scheduled to be debated in parliament 14 Nov

- Catalan government asks Supreme Court to suspend Article 155

- Norway's Norges Bank leaves key rate unchanged at 0.5%

- Sweden's Riksbank leaves key rate on hold at -0.5% as expected

- RBA's Debelle says there's still sizeable spare capacity in labour market

- UK full-time workers inflation-adjusted weekly earnings decrease by 0.4%

- Spain De Guindos sees 2017 GDP growth just above 3%

- Japan Post Insurance intend to keep unhedged foreign bond buying steady Oct-March

- PBOC gauges demand for 2-month reverse repos

- Forex option contract expiries for today 26 Oct

- Trading ideas for the European session

- ForexLive Asia FX news wrap: USD a wee drip (technical term) lower

Data:

- Germany Nov GFK consumer confidence 10.7 vs 10.8 exp

- Eurozone Sept M3 money supply yy 5.1% vs 5.0%

- UK CBI Oct retailing reported sales -36 vs +14 exp

- Spain Q3 unemployment rate 16.38% vs 16.5% exp

ECB meeting obvuiously the main event today but that's not stopped action in other ccys as we wait on Draghi & Co to spill the beans, or not, on QE tapering.

EURUSD has slid to test 1.1800 from 1.1835 but EURGBP rallied to 0.8957 from 0.8915 as GBPUSD came in for a reality-check sell to 1.3179 from 1.3275 after yesterday's GDP-led rally that tested 1.3280 resistance. A decent bounce from the lows though to test 1.3230 before capping again.

GBPUSD15m

AUDUSD had a tumble to 0.7679 from 0.7705 on dovish comments from RBA dep gov Debelle but has since rallied well to post 0.7718 as I type.

USDJPY found support into 113.40 and has tested 113.80 resistance before retreating to 113.65 while USDCHF has remained underpinned and made steady progress to 0.9909 from 0.9880 with EURCHF pinned around 1.1700

USDCAD has been flat-lined between 1.2780-1.2810 after yesterday's pre/post-BOC fun and games while NZDUSD is still looking for friends around 0.6865.

Gold has been down to 1277 from 1282 while oil rallied first before retreating

Equities opened in uncertain mode but the IBEX has rallied 1.3% to post 2-week highs in the wake of Catalonia reportedly choosing elections in Dec rather than declare independence.

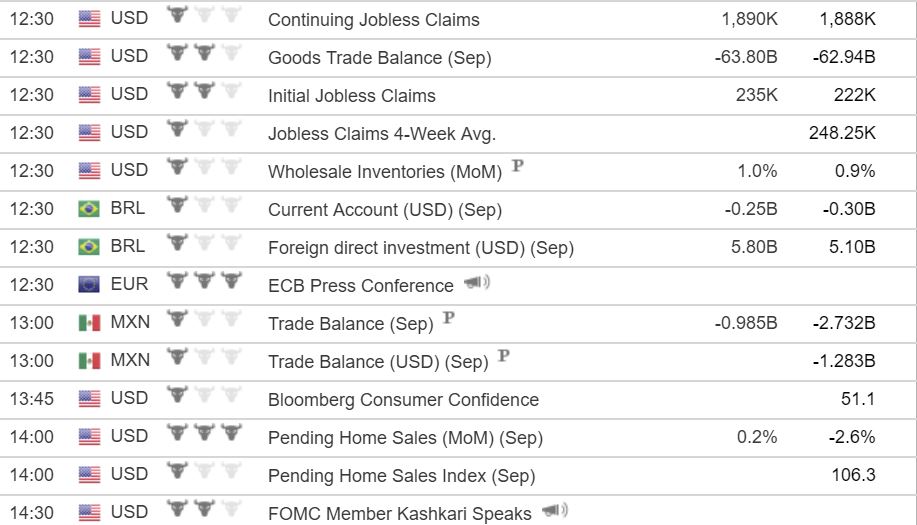

US initial jobless claims and housing data on the calendar but it's the ECB that will shortly be hogging the headlines.