Forex news for NA trading on January 12, 2018.

- Longs in EURUSD crushing the shorts. Trades above 1.2200 now. Dollar index at 3 year low.

- Fed's Rosengren (more of a hawk): further jobless rate drop risks undermining recovery

- And its another record. All three indices higher on the day

- CFTC commitment of traders: EUR longs increase by 17K to another record long level

- BAML: Stock funds see 6th biggest equity inflow total ever last week.

- Crude oil futures settle the day/week at $64.30

- Canada PM Trudeau: Optimistic three NAFTA nations can agree on improvements

- Lower dollar has the price of gold moving higher

- US dollar index tests the 2017 low

- USDCAD gets in the dollar selling. Breaks 100/200 hour MAs

- US Baker Hughes total rig count rises to 939 from 924

- Fed's Harker: Sees two rate hikes in 2018

- There is no new agreement between Spain, Netherlands on British departure

- UK FTSE closes at another record. European stocks higher today.

- Atlanta GDPNow estimate rises to 3.3% from 2.8%

- ECB Weidmann: Announcing QE end date is justifiable

- New York Fed's GDP Nowcast projection for 4Q growth lowered to 3.88% vs 3.97% last week

- BOJ seen upgrading growth outlook for 2018: Nikkei reports

- US Nov business inventories +0.4% vs +0.4% expected

- People are not happy about the maintenance outage at the Kraken crypto exchange

- Gulf oil producers plan to keep Q1 output below earlier levels - report

- Mnuchin says he's 'very focused' on cryptocurrency regulation

- Spanish and Dutch are said to agree to seek soft Brexit deal - report

- US December retail sales control group +0.3% vs +0.4% expected

- US December CPI 0.1% m/m vs +0.1% m/m expected

- The EUR is the strongest, while the AUD is the weakest as NA traders enter

- ForexLive European FX news wrap: Euro soars to three-year highs after conclusion of German coalition talks

A snapshot of the other markets at the end of the week is showing:

- Spot gold up $16.14 or 1.22% at $1338.50

- WTI crude oil futures $.68 or 1.07% at $64.48

- US major stock indices closed higher (once again) and at record levels (once again). For a look at the changes for the day, week and +YTD, CLICK HERE.

- The US yields is ending the day with modest rises. 2 year 1.997%, up 1.9 basis points. Five-year 2.3448%, up 1.9 basis points. 10 year 2.548%, up 1.1 basis points. 30 year 2.850%, -1.6 basis points

It is the day before a 3-day holiday in the US, and you might expect a quiet afternoon. That was not the case today.

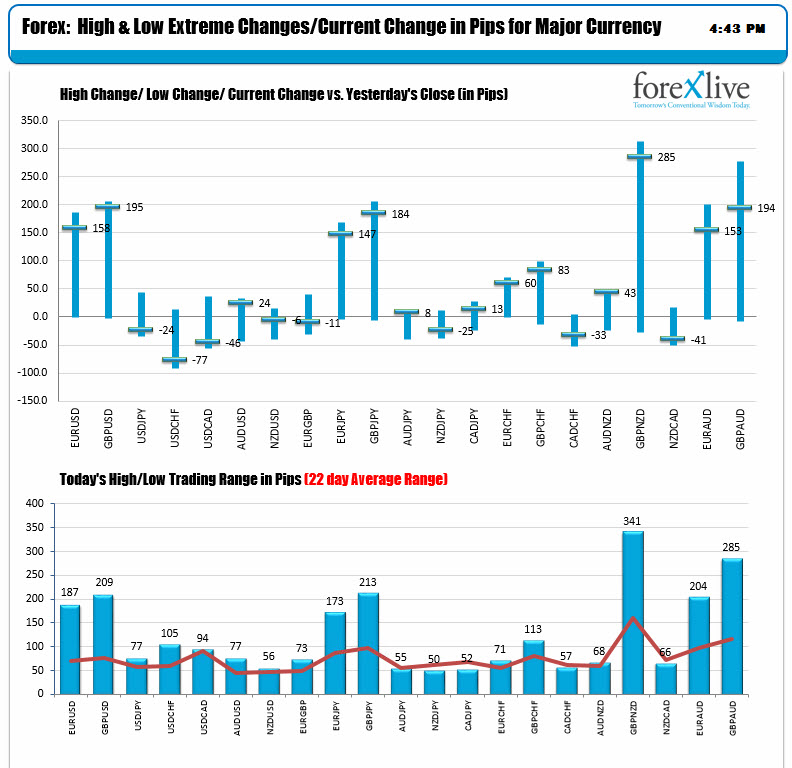

The dollar was kicked lower in the US afternoon trading with the EURUSD ending the day up about 160 pips and near the highs (dollar lower). The GBPUSD up 195 pips and near the highs (dollar lower), The USDCHF down -77 pips and near the low (dollar lower). The USDCAD down -46 pips and near the low (dollar lower). The USDJPY down -24 pips and near the lows. The AUDUSD up 24 pips and near the highs (dollar lower) after an down and back up day. The only pair vs the dollar that did not do much was the NZDUSD.

BTW the US dollar index dipped below the 91.00 level and in doing so, traded at 3 year lows (lowest since January 2015).

All that dollar selling, sent gold prices up another $16.14. Oil also went higher.

The US stocks seemed to like the idea of a lower dollar. It closed once again at record levels. The S&P and Nasdaq are up 8 of 9 days in 2018. The Dow has had 3 days (of 9) with gains of over 200 points.

A lower dollar makes US goods abroad cheaper but increases the price of imports. Who cares about that? There are tax cuts and inflation is still low despite the 1.8% rise in core CPI today which was higher than the 1.7% expectations.

Who cares if wages are starting to go up? We saw the likes of Walmart raise minimum wages, and top that off with a bonus.

Well, the treasury market may mind. However, with German 10 year yields at 0.581%, how can the US 10 year at 2.546% not be a good deal? That is a pretty good head start - yield wise. PS US 10 year yields at 2.54% are still higher than France, UK, Spain, Italy and Portugal 10 years (Italy is the highest at 1.98%). Greece still has the US beat at 3.89%.

Inflation may heat up and that may force the Fed to tighten more than expectations, lead to lower stocks and slow the economy. But until then, shouldn't the dollar go up, not down? HMMMM. Makes you want to pay more attention the charts.....

Hoping you all have a great weekend....