Forex news for trading on September 13, 2017.

- Record closes for the bunch. S&P, Nasdaq and Dow close at record levels.

- Forex technical analysis: What levels to eye through the AUD employment report

- UK Chancellor Hammond says during Brexit transition cliff edge will be avoided

- Trump comments on bipartisan talks on tax reform, healthcare, DACA

- US crude oil futures settle at $49.30/bbl.

- US monthly budget for August shows a deficit of -$107.7b vs -$119.0b estimate

- BOE Cunliffe on Sky news: Looking very closely at consumer lending

- OMB Director Mulvaney: Trump meeting with bipartisan leaders on tax reform at WH

- ECB Praet: Risks of deflation has largely disappeared

- US sells 29 year and 11 month bonds at high yield of 2.79%

- ECB QE broke EUR/CHF. Now QE is coming to an end

- Ted Cruz abandons fiscal conservatism. Wants tax plan that increases debt

- Bitcoin continues the Jamie Dimon fall today but stalls near retracement target

- Trump said to invite Schumer and Pelosi to dinner

- Weekly US oil inventories +5889K vs +4911K expected

- Euro spills to a six-day low. Tax plan helping US dollar

- US dollar gets back into gear

- Propaganda has completely changed and everyone is trying to figure out what comes next

- Teranet August Canada house price index +13.1% vs +14.2% y/y prior

- US PPI final demand 0.2% vs 0.3% estimate MoM

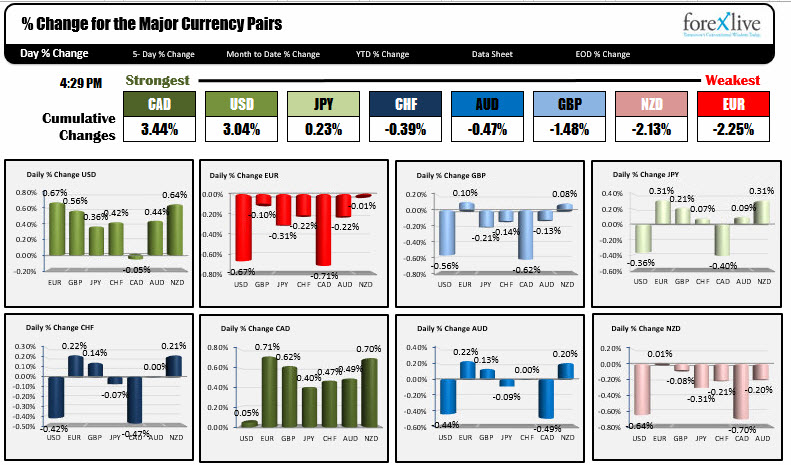

- The CAD is the strongest and the NZD is the weakest in the morning snapshot

In other markets, a snapshot at the end of day shows:

- Spot gold down -$9.49 to $1322.42. Gold is following the dollar. If the dollar goes up like it did today, gold goes lower and visa versa. Today was a down day

- US WTI crude oil i sup $1.09 or 2.26% to $49.33. The 200 day MA is just ahead at $49.54. The IEA said in its monthly report that robust global demand and an output drop from OPEC and other producers should help balance inventories.

- US yields are modestly higher. 2 year 1.3471, up 1.2 bp. 5 year 1.7670%, up 2.1 bp. 10 year 2.1883%, up 2.1 bp 30 year 2.781%, up 1.5 bps

- US stock indices all closed at record levels. The S&P closed up 0.08%. The Nasdaq closed up 0.09%. The Dow closed up 0.18%. Breaking records.

With the Republicans holding a slim majority on Capitol Hill, if Trump can get some conservative Democrats to meet him more in the middle somewhere, could more deals be made? Yes.

Last week Trump accepted a Democratic plan for the debt ceiling extension. It really was not a huge thing. He kicked the can down the road to December. He avoided any embarrassment from a fight on keeping the government open while hurricane Irma bore down on the US, and Harvey left a path of destruction in Houston. Politically, he spat in the face of the likes of Speaker of the House (R) Paul Ryan and even his treasury secretary, but he started more of a dialogue with the other side. It was a low risk move. He/they can deal with the debt ceiling in more detail in December. It made sense.

More recently, he has been engaging more with the opposition in order to try to get more bipartisan support for the bigger ticket items like tax reform, healthcare reform, even DACA. He met with 13 members of Congress - 8 were Democrats and 5 were Republican. He will have dinner with Senator Schumer and Nancy Pelosi - Senate and House minority leaders.

The dollar liked the idea.

Now, maybe it is pie in the sky. Maybe there is no way when the rubber meets the road the left will move from the left and the right wil move from the right.

However, if you look backward, you see continued division in Washington, and the potential for more and more of the stalemate in healthcare, tax reform, DACA/immigration. There needs a new approach to solve the problems. Yes, everyone risks pissing off the voters who voted for them. What's new. Plus not everyone who voted Dem or GOP is a raving mad Dem or GOP-er.

It'll be interesting how it all pans out, but for the day at least, the dollar seemed to like what it saw.

Other news today saw US PPI come out a little weaker than expected. The US oil inventory data showed a greater than expected build of inventories but the market ignored the data and oil rose about $1.00.

Technically speaking:

The EURUSD stalled in the Asian and London morning session against the 100 hour MA. In the NY session the price fell below the 200 hour MA at 1.19504 and then the low from yesterday at 1.19255. The selling did not abate until the pair had retested support near the 1.1876 swing low from 2010 and a trend line on the daily chart around 1.1878. The low for the day reached 1.1873. In the new day a break back below the 1.1876 level is more bearish. The 100 bar MA on the 4-hour chart at 1.1913 is now resistance.

In Australia the employment report will be released. For a look at the technical levels, CLICK here.

The GBPUSD fell below its 100 hour MA at 1.3205 on the way to a low of 1.31824. The price quickly rebounded and traded above and below the 100 hour MA for the rest of the day. In the new day, look for a momentum break. The BOE does meet tomorrow and will release it's statement. That should limit up and down activity (or so it seems it would). Nevertheless, look for a move away from the 100 hour MA at least for a momentum trade.

Below are the % changes of the major currencies vs each other. The CAD and the USD were the strongest, while the EUR and the NZD were the weakest.