FX new for NY trading on August 14, 2017.

- S&P index ends the session up 1.00%. Nasdaq even better.

- US trader representative Lighthizer: Will conduct thorough investigation of China's intellectual property practices

- German FM Schaeuble: Most people expect the ECB to take a further step at Sept meeting

- Crude oil futures settle at $47.59 /bbl

- A little bit of something for everyone...

- Forex technical analysis: AUDUSD moves toward low from Friday

- Fed Dudley: Sees US growth at 2%. Little change since year began

- Bitcoin races higher. The 2nd consecutive Monday gap

- Trump: Racism is evil. Denounces hate groups as being repugnant

- German FM Schauble: Euro area is doing much better than what most thought

- European stocks looking good at the start of the week

- NY Fed Survey: 3 year ahead inflation expectations dips to 2.7% from 2.8%

- ECB slowing down on overall asset purchases w-e 11 Aug

- Swissy still in retreat and yen holding as we approach option expiry time

- Trump quickly reacts to Merck CEO Frazier stepping down from industrial counsel (and it isn't to thank him for his service)

- Teranet/National Bank HPI (July) 2.0% vs 2.6% last month

- Bundesbank Dombret: European recovery is sustained and robust

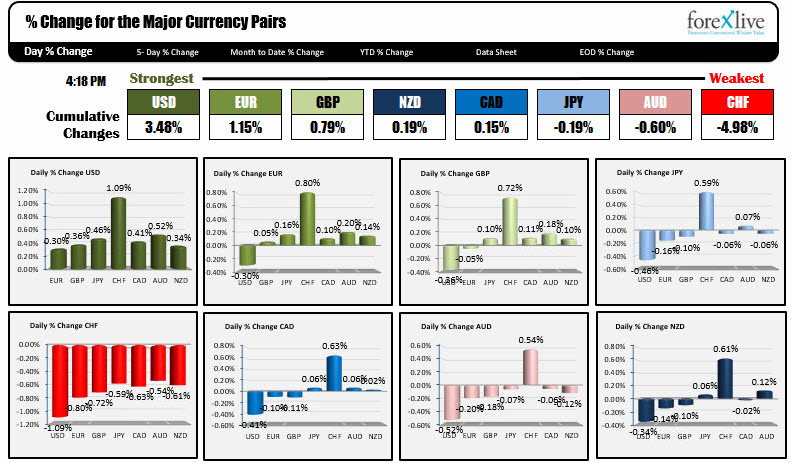

- The USD is the strongest. The CHF is the weakest.

A snapshot of other markets as the NY session comes to an end.

- Spot gold down -$7.47 to 1281.86

- WTI crude oil is ending down -$1.31 or -2.68% to $47.52. Concerns that China demand is slowing

- US stocks ended the session with solid gains. The Nasdaq led the charge up 1.34%. The S&P is up 1.0%. The Dow ended the day up 0.62%.

- US yields rose. 2 year 1.3202%, up 2 bp. 5 year 1.7708%, up 3 bp. 10 year 2.222%, up 3.3 bp. 30 year up 2.812%, up 2.6 bp

The USD was the strongest currency of the day on the back of less concern about war with No. Korea. That led to higher stocks in Europe and the US (Dax up 1.26%, Cac up 1.20%, Nasdaq up 1.34%). Yields moved higher on the back of a reversal of the flight to safety bid. Gold and commodities went lower reversing some of the flow from the lower dollar last week.

News wise the calendar was void of any US economic news.

NY Fed Governor Dudley did speak and although he said his economic forecast is really little changed from the start of the year, he could see another hike in 2017 if the economy evolves as expected. That helped to give the dollar a little extra bid in the NY session. Dudley also did say that the market's expectation for a September balance sheet taper is not unreasonable.

Germany's FM Schaeuble commented that most people expect the ECB to take a further step at September meeting toward exiting very expansive monetary policy but he cautioned that the ECB needs to be careful when ending the ultra loose policy. In a sign of solidarity with the ECB, he did comment, "I hope it goes well".

In the never ending saga that is President Trump, he came on television to denounce racist hate groups. On Saturday he chose to tweet his disdain for the actions in Charlottesville, VA with a less than forceful message to groups. Today Merck CEO Kenneth Frazier resigned from Trump's American Manufacturing Council saying his resignation was his way of taking a stand against "intolerance and extremism". Frazier is an African-American. Trump - not pleased with the full statement - replied in Trumpesque fashion, "Now that Ken Frazier of Merck Pharma has resigned from President's Manufacturing Council,he will have more time to LOWER RIPOFF DRUG PRICES!" Geez.... Anyway, the market it is getting more and more immune from the stuff that goes on in Washington and comes out of the Presidents mouth/from his typing fingers. The dollar and stocks if anything moved higher.

Below is the % changes of the major currencies vs each other. While the USD was the strongest, the CHF was the weakest as it too lost it's flight to safety status from last week.

Some techinical thoughts in the new trading day.

- The EURUSD sits above its 200 week MA, 100 hour MA and 50% retracement on the hourly chart at 1.1767-69. That is support. On the topside, the 200 hour MA at 1.17958 is the resistance. The NY session traded between those goal posts.

- The USDJPY traded above and below the 100 hour MA at 109.58. The price is ending the session right near that MA level.

- On the wide, the GBPUSD is between support at 1.2938 to 1.3030. In between, is the 100 hour MA at 1.2989 (the price stalled at the level during a NY test) and 1.2950 below. The low today reached 1.2955. The 1.2950 was triple bottom last week UNTIL broken briefly (and failing) on Friday.

- Last week the CHF was pushed around by the flight into the safety of the CHF (USDCHF lower). Today, the price retraced the move lower stalling near the close on Friday August 4th at 0.9726. The 200 hour MA is below at 0.96825. That should be support/risk defining level, if the buyers decide it is time to take this pair higher again. The 100 day MA at 0.9775 is right near the high from last week at 0.97725. If going higher, trading back above the 100 day MA would be a step in the bullish direction. PS the price of the USDCHF has not traded above the 100 day MA since May 11.

- Who needs currencies when you can trade cryptocurrencies. The price of bitcoin is up 18%-19% today and 51% August 4th.