Forex news for NY trading on February 14, 2018

- US stocks end the session with solid gains

- South African President Zuma says he has been "compelled to resign" by party motion

- S&P reaches the 50% retracement target (well almost)

- Active shooter situation at a high school in Florida

- Iran arrests 90 FX traders in bid to halt rial slide

- Crude oil contract settles at $60.60/BBL

- Gold has made an impressive comeback ahead of Chinese new year

- 10 year yield hits a 4 year high at 2.91%

- Dollar decline continues. New lows vs. all the major currencies (sans the JPY)

- USD shorts just turned on the afterburners

- What does the Chinese year of the dog mean for the forex market? A historical look

- AUDUSD back to the highs. Employment to be released in the new trading day

- Higher CPI sends the USD lower (hmmmm). USD is the weakest currency as London exits

- Bitcoin is feeling the love today

- Everyone lowered their GDP forecasts after retail sales

- Atlanta Fed GDPNow Q1 forecast lowered to 3.2% from 4.0%

- The crowded long-USD/JPY trade is feeling the squeeze

- US Senators say they have a deal on DACA

- This is the kind of reversal that looks really bad on the US dollar

- US EIA weekly oil inventories +1841K vs +3100K expected

- VIX falls below 20, equities jump higher as the US dollar wilts

- US December business inventories +0.4% vs +0.3% expected

- US CPI data prompts Fed Funds futures showing 23% chance of 4 Fed rate hikes in 2018

- US stock futures tank after jump in inflation, drop in retail sales. What to watch

- US January advance retail sales mm -0.3 % vs 0.2% exp

- Canada Teranet/National Bank HPI January MoM 0.3% vs. 0.2% last

- US January CPI +0.5% m/m vs +0.3% expected

- The NZD is the strongest and the GBP is the weakest before CPI and retail sales

A snapshot of other markets is showing:

- Spot gold up $21.11 or 1.59% at $1350.74

- WTI crude oil futures higher by $1.52 or 2.57% at $60.71

- Bitcoin is trading up $725 at $9293.94. The digital currency moved away from its 100 hour moving average and broke above a topside trend line (CLICK HERE). Litecoin is also sharply higher on the day. It is up 30% on the day.

In the US stock market today, prices rose sharply on the back of less fear from accelerated Fed tightening. GDP estimates were lowered on the back of weaker retail sales. The major indices are now up 4 straight days

- S&P rose 35.69 points or 1.34% at 2698.63

- NASDAQ rose 130.10 points or 1.6% at 7143.62

- Dow industrial average rose 253 points or 1.03% at 24893.49.

In the US debt market today, yields were not as sanguine about inflation. The 10 year yield traded at the highest yield in 4-years.

- 2-year 2.167%, up 6.3 basis points

- 5-year 2.642%, up 10 basis points

- 10 year 2.911%, up 8.2 this points

- 30 year 3.171%, up 6.0 basis points

There was a lot of anxiety coming into the day on inflation fears from the US CPI release. Retail sales were also adding another level of anxiety and fear.

The CPI ended up coming in higher than expectations at 0.5% vs 0.3% expected. The core was also higher at 0.3% vs 0.2% expected. This led to a larger YoY of 2.1% vs 1.9% and core at 1.8% vs 1.7% but those numbers were unchanged from the prior month. Not so alarming was that real avg weekly earnings rose by 0.4% YoY vs 0.9% prior. That seemed to lessen the inflation fear.

Also contributing to less fear, was that retail sales fell -0.3% vs 0.2% expected. The other breakdowns were also weaker (click here for the full report).

As a result of the weaker number, GDP estimates for the 1Q were lowered. As an example, the Atlanta Fed estimate was lowered to 3.2% from 4.0%. Remember the excitement when that index was up at 5.4% not too long ago. It is moving back down as more and more data points are known. Other economists estimates target 2.4% to 2.6% growth which is a lot less inflation fearing.

The initial impact from the data was a sharp rise in the US dollar. However, after the initial spike, sellers of the greenback started and a massive reversal was underway helped by technicals.

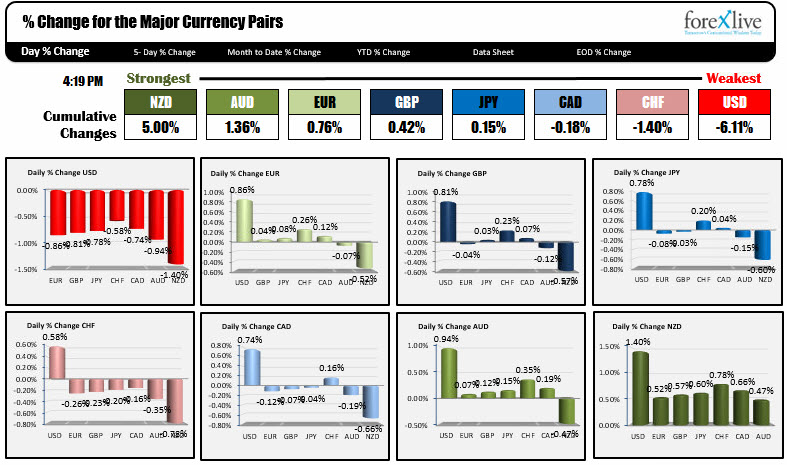

The USD is ending the day as the weakest of the major currencies with the NZDUSD the biggest mover at 1.4%. The dollars fall vs the CHF was the least at 0.58%. The losses were broadbased. The NZD was the strongest currency of the day. It got a boost early in the trading day on the back of better inflation expectations. However, it certainly had it's share of ups and downs in the NY session too. There is a technical rundown of many of the currency pairs vs the USD HERE.

The US day ended with yet another mass shooting at a school. According to reports, this is the 18th in 2018 (we are only in the middle of February) and at least 20 injured and 1 dead is what is being reported. It certainly put a damper on the Valentines Day/Ash Wednesday. Thoughts and prayers to all.