Forex news for New York trading on July 14, 2017

- US June CPI +1.6% y/y vs +1.7% y/y expected

- June US retail sales -0.2% vs +0.1% m/m expected

- U Mich July preliminary consumer sentiment 93.1 vs 95.0 expected

- June US industrial production +0.4% vs +0.3% expected

- US kills head of the Afghanistan wing of ISIS

- Fed's Evans: Weak early-year GDP seems transitory

- Baker Hughes weekly US oil rig count 765 vs 763 prior

- Goldman Sachs sees slim chance of a Fed hike before December

- NY Fed trims Q2 GDP Nowcast

- Fed's Kaplan: April, May inflation data was somewhat better than March

- Kaplan: Would like to see more progress on inflation before hiking again

- May US business inventories 0.3% vs 0.3% last month

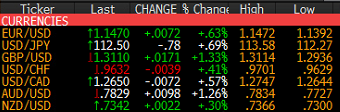

Markets:

- GBP and AUD lead, USD lags

- Gold up $11 to $1228

- WTI crude up 52-cents to $46.60

- US 10-year yields down 2 bps to 2.33%

Before it even start, you knew it would be a big day for the US dollar. The Fed had said for months that good news was coming and with CPI and retail sales on the docket, the was a chance for fireworks. The Fed only needed a bit of good data to start feeling good about hikes.

Instead, CPI and retail sales both missed estimates. There was some good news in wages data but it was overshadowed by weak inflation and consumer spending. The US dollar fell 50 pips on the headlines and never recovered. Later, softer consumer sentiment led to another wave of selling.

Cable had been near 1.30 all week and busted through on CPI and then continued through the May highs to finish up 170 pips and at the highs of the day. That's a big signal for the pound as the market brushes off the election, weak UK data and Brexit.

AUD/USD also made a move as it rose to a one-year high above the election-night high. It also finished up 100 pips and at the highs of the day at 0.7828.

USD/CAD, meanwhile, broke below Wednesday's post-BOC lows and also took out the June 2016 low.

The euro gained 70 pips and is on the cusp of breaking to new highs as well.

USD/JPY sank below 113.00 on the headlines and continued to as low as 112.27. It was given a bit of life by a fresh record in the stock market but it only managed to bounce to 112.50 into the close.

Looks like we're setting up for more action in the week ahead. Have a great weekend.