Forex news for NY trading on December 15, 2017

- US stocks end the session with strong gains. Record closes for the all the indices

- CFTC commitment of traders: EUR longs the highest since May 2007

- Republican Senator Corker to vote "Yes" for the tax bill

- It's Friday, that means the commitment of traders report will be out soon

- Marco Rubio confirms he will support tax bill

- How to create shareholder value in the bitcoin mania

- EURUSD makes a run at the lows/swing area

- Baker Hughes US oil rig count 747 vs 751 prior

- No single trading strategy dominated 2017 - Credit Agricole

- This week in FX was all about the Australian and New Zealand dollars

- Solid gains in the cards for EUR/USD next year - ING

- Mixed finish for European stock markets

- NY Fed Nowcast GDP estimate up to 4.0% from 3.9%

- US tax bill to be released today: All the latest

- Chicago Fed President Evans explains his dissent

- Theresa May: We will leave the EU on March 29, 2019

- US November industrial production +0.2% vs +0.3% expected

- It's all about the cross-currency basis today

- Canada October manufacturing sales -0.4% vs +1.0% expected

- US Empire manufacturing for December 18.0 vs. 18.7 estimate

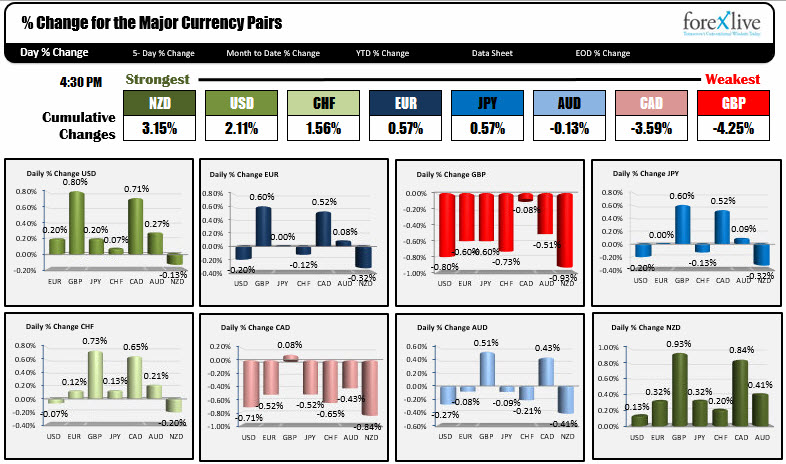

- The NZD is the strongest, while the GBP is the weakest as NY traders enter

- ForexLive European FX news wrap: Tax woes weigh on the USD, while GBP slips ahead of Brexit trade talks

A snapshot of markets near the end of the week are showing:

- Spot gold of $2.80 or 0.22% at $1255.73

- WTI crude oil futures up $.30 or 0.53% at $57.34

- US yields are mixed with the yield curve continuing to flatten: 2-year 1.8358%, +2.4 basis points. 5-year 2.1504%, +1.2 basis points. 10 year 2.3494%, unchanged. 30 year 2.685%, -2.1 basis points

- US stocks advanced. S&P index +0.9%. NASDAQ composite index +1.17%. Dow industrial average +0.58%

The votes for the tax reform package are starting to line up. Marco Rubio received concessions on the Child Tax Credit and Bob Corker, who opposed the Republicans tax plan last week, said that he still had reservations but did not want to let a "once in a generation" opportunity pass by (click here).

Those "Yes" votes, helped to send an already up stock market, to even new highs. The major indices ended the day with solid gains led by the Nasdaq up at up 1.17%. That gain pushed the Nasdaq to the head of the table for the week with a 1.41% gain. The other major indices were also higher for the week, with the Dow up 1.33% and the S&P up 0.92%. The strong stocks also helped the USD move higher today.

Looking at the % changes of the major currencies vs. each other, the USD was up against all currencies with the exception of the NZD. The largest gains for the dollar came against the GBP which fell on Brexit concerns (the GBP was the weakest currency today), and the CAD. Manufacturing sales in Canada disappointed earlier in the day (-0.4% vs estimate of 1.0% gain).

In other news today,

- The Empire manufacturing index for December came in at 18.0 versus 18.7. However it still remains near higher levels

- US industrial production came in a little less than expectations at 0.2% vs 0.3% but the prior month was revised up to 1.2% from 0.9%. Capacity utilization rose to 77.1% from 77%, but was a touch lower than expectations of 77.2%.

- Oil rigs were lower by 4 in the current week (747 vs 751 last week). Total rigs were only down 1 (gas rigs were up 3)

- The CFTC commitment of traders showed that the EUR longs increased to the largest long position since 2007.

Technically,

- The EURUSD fell back below the 100 hour MA and an upward sloping trend at 1.1779 area and stayed below. It is closing at lows for the day at 1.1750. In trading on Monday, the pair may retest the 1.1712-24 area. That was home to swing high and low levels going back to September 27th. It held support on Tuesday.On the topside, the 100 hour MA (at 1.1779) is resistance

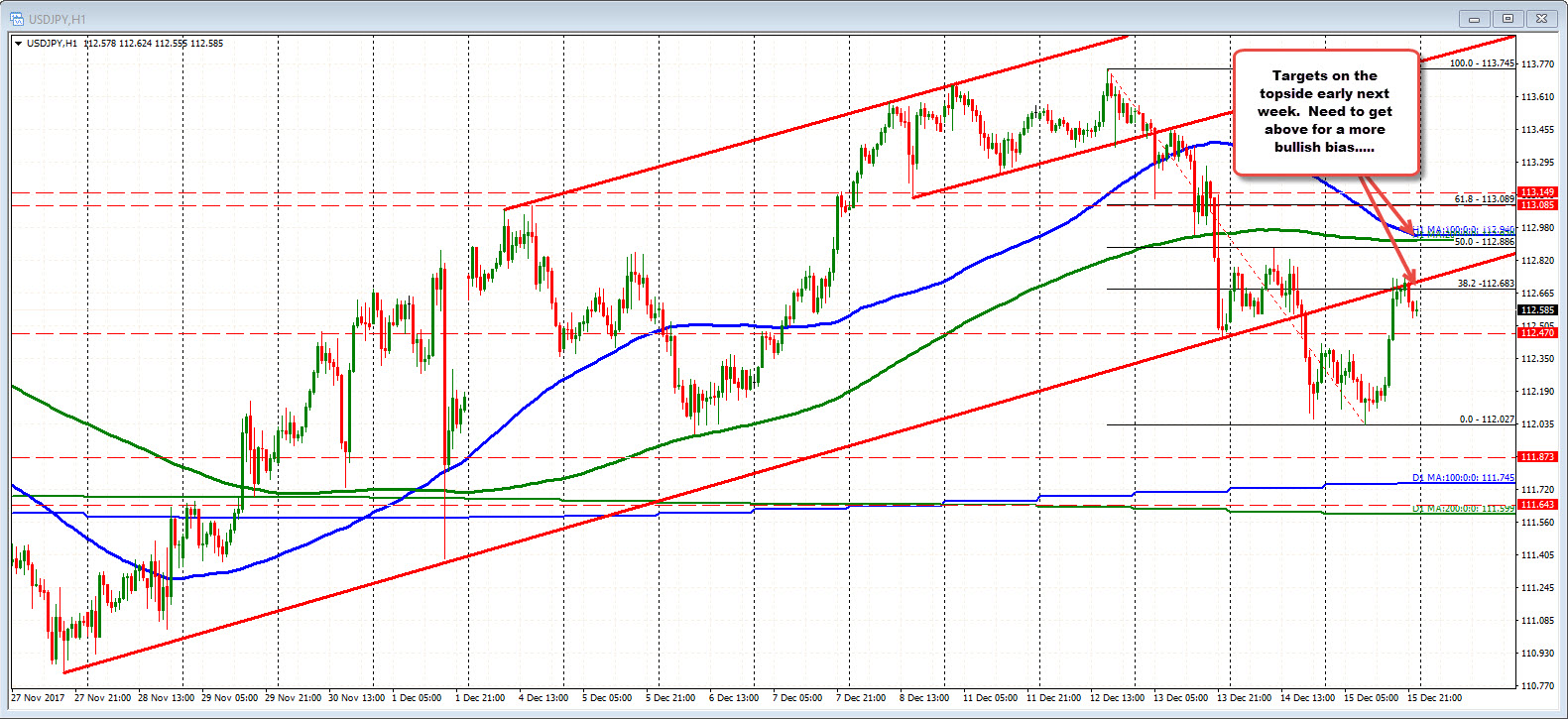

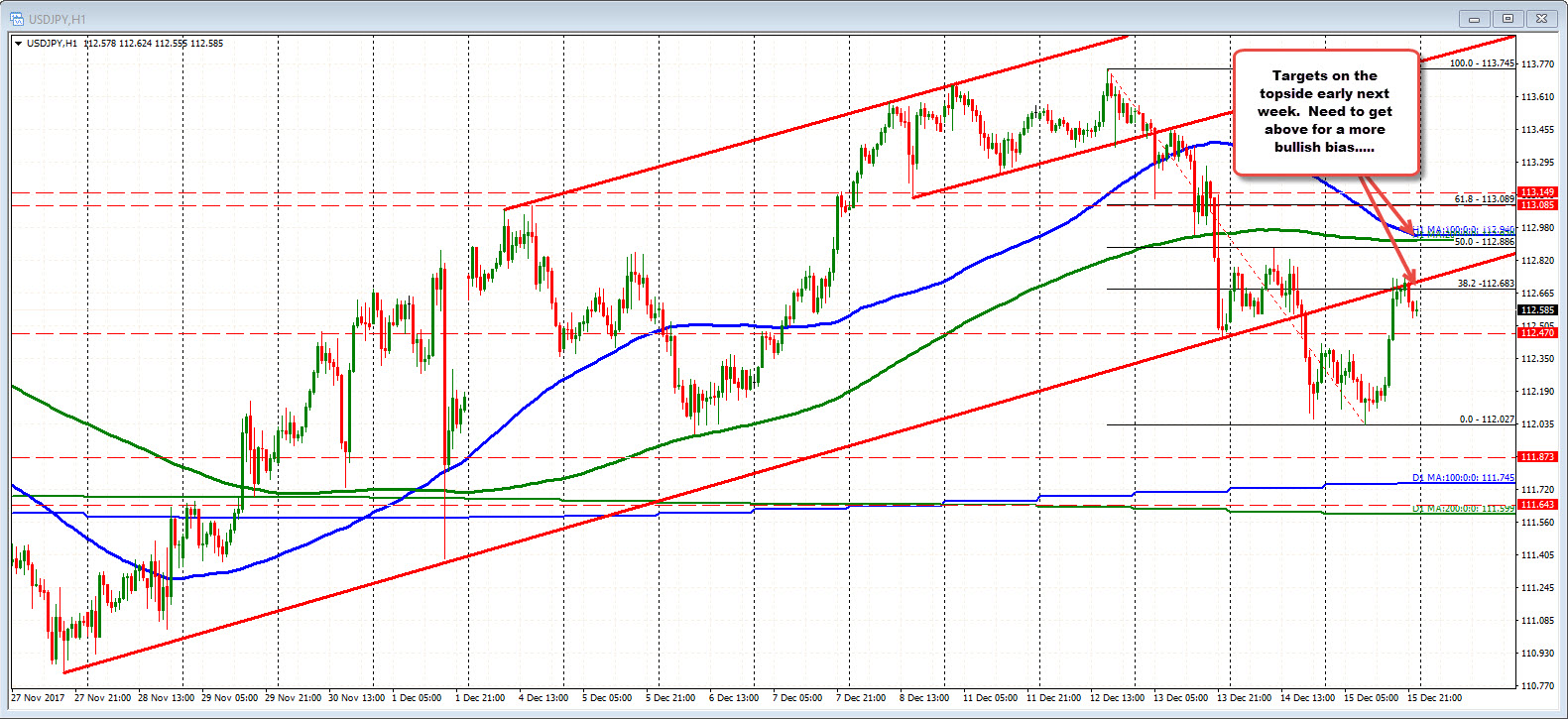

- The USDJPY rallied up to the underside of a broken trend line at 112.72 and stalled (see chart below). That will be a level - followed by the 100 and 200 hour MAs at 112.88-94 - are levels to get above for the buyers/bullls in the new week. Stay below those levels and the Friday buyers may look to turn the beat around (to the downside)

- The GBPUSD was the weakest currency today but stalled at the 1.3300 level. That was the low from earlier in the week too. The pair is closing not far from that level at 1.3323. A move below the 1.3300 level and the 50% of the move up from the November low at 1.32938, will be more bearish.

- The USDCAD moved sharply higher today and tested the week's highs at 1.28916. Sellers came in and pushed the pair off the peak to 1.2865 at the close. A move above the double top, will be more bullish next week. On the downside, there is a bunch of MAs to get back below including the 100 hour MA at 1.2831 and the 200 hour MA at 1.2815. Manufacturing sales were not good today. That, and the USD strength, sent the USDCAD back to the upside today..