Forex news for trading on March 15, 2018

- US stocks ending the session mixed. Tech lags. Industrials outperforms

- Israel believes Trump will most-likely withdraw from Iran nuclear deal in May - report

- Euro and the commodity currencies fall to fresh lows

- Iran-Saudi Arabia relations aren't exactly a lesson in diplomacy

- Crude oil futures settle at $61.19/BBL

- Mueller subpoenas Trump Organization to turn over documents, some related to Russia

- It was literally raining gold and silver at an airport in Siberia

- Forex technical analysis: USDJPY runs into a brick wall and falls back

- Peter Thiel: "I'm long Bitcoin, neutral to skeptical on everything else" in crypto

- European stocks end the session with gains

- Bitcoin will fall to $5,873; or it will go to $91,000; or both

- EURUSD keeps the bearish fire burning

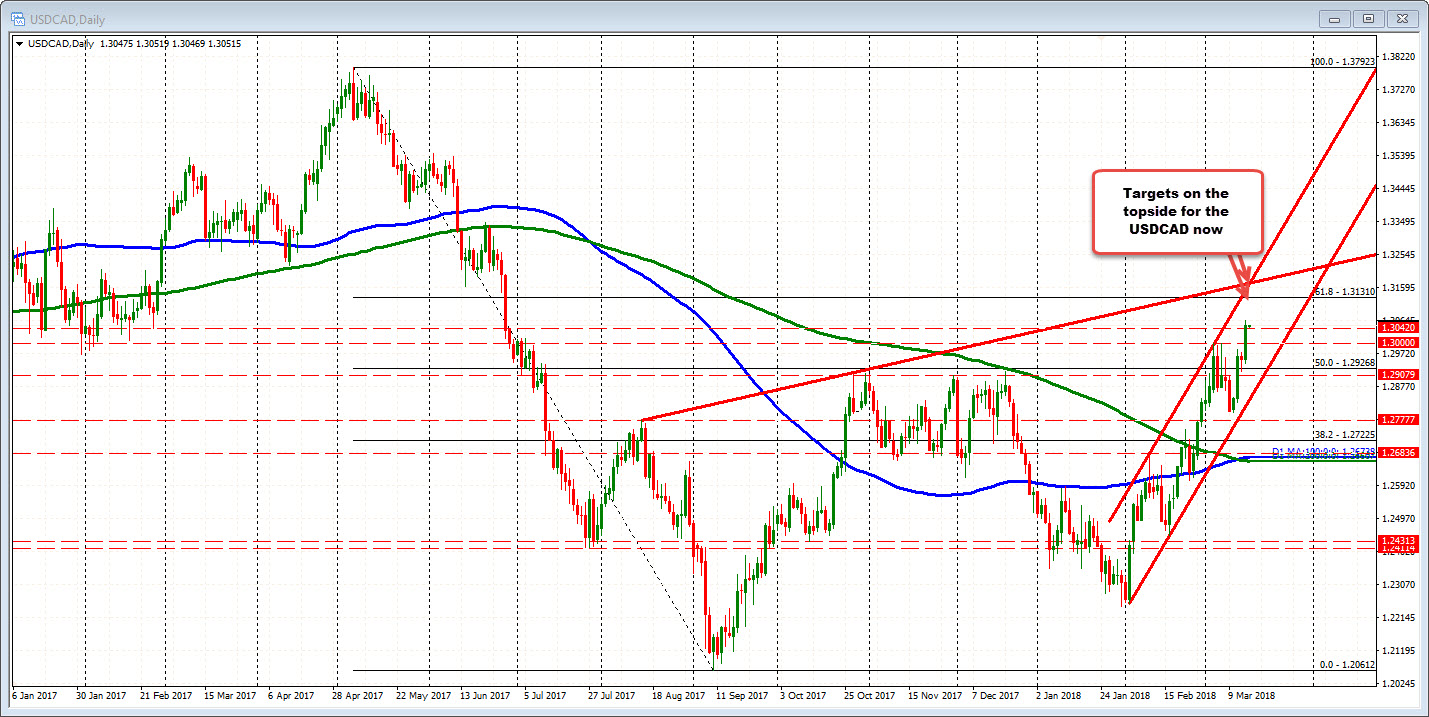

- The USDCAD break of 1.3000 was key, but there is another key break today.

- Economists see slightly higher path of rates in latest WSJ survey

- Bitcoin technicals: Bitcoin corrects higher after fall below $8000 stalls, but bears are still in control

- US Treasury hits Russia with fresh sanctions

- Mexico economy minister says you have to be ready for NAFTA without USA

- March US NAHB housing market index 70 vs 72 expected

- USD demand generally prevailing but it's not quite that simple

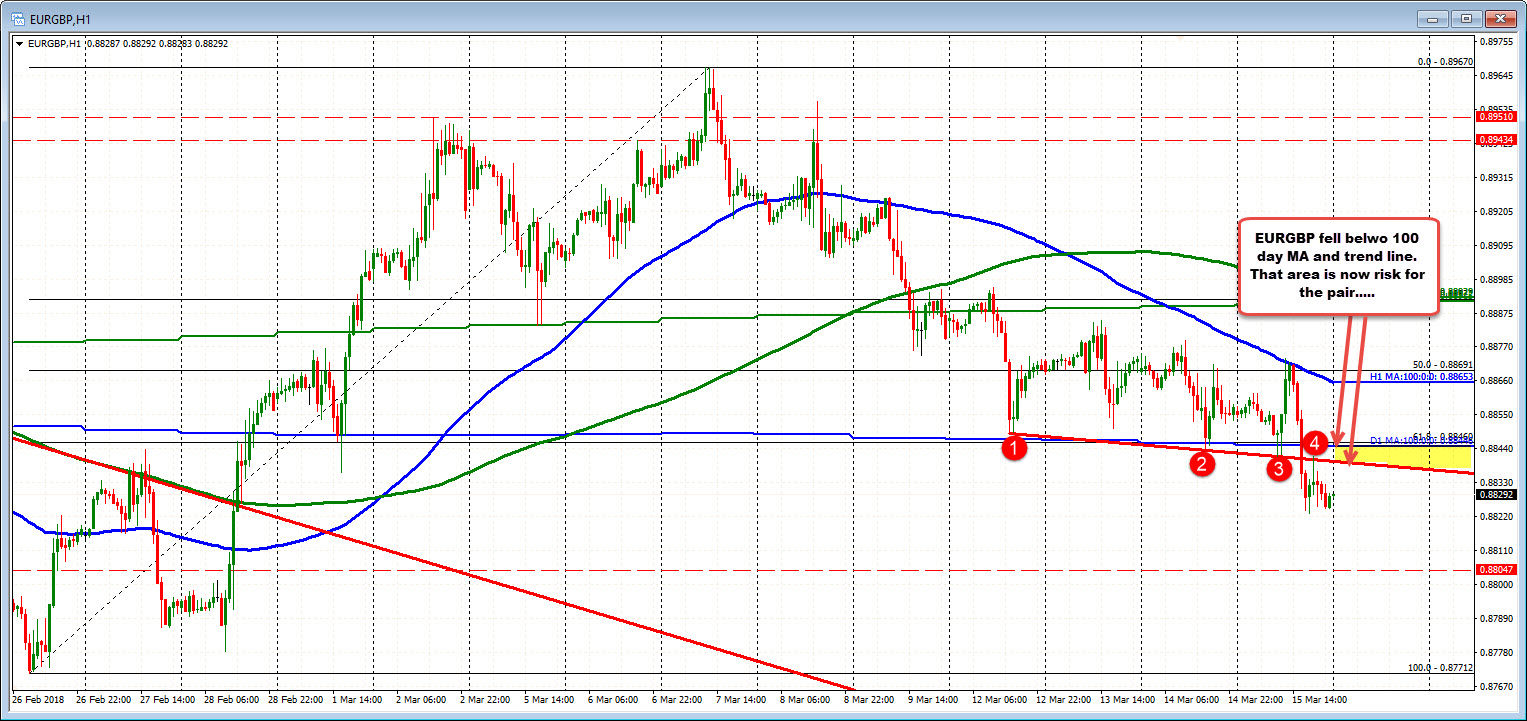

- Forex technical analysis: EURGBP is waggin' the dog(s) today

- Trump tweets about trade surplus with Canada

- Canada Feb existing home sales -6.5% vs -14.5% prior

- US, UK, Germany and France say " we are shocked" by nerve agent attack on Skripals

- March Philly Fed +22.3 vs +23.0 expected

- US initial jobless claims 226K vs. 228K expectations

- US February import price index mm 0.4% vs 0.2% exp

- US March Empire Fed manufacturing index +22.5 vs +15.0 expected

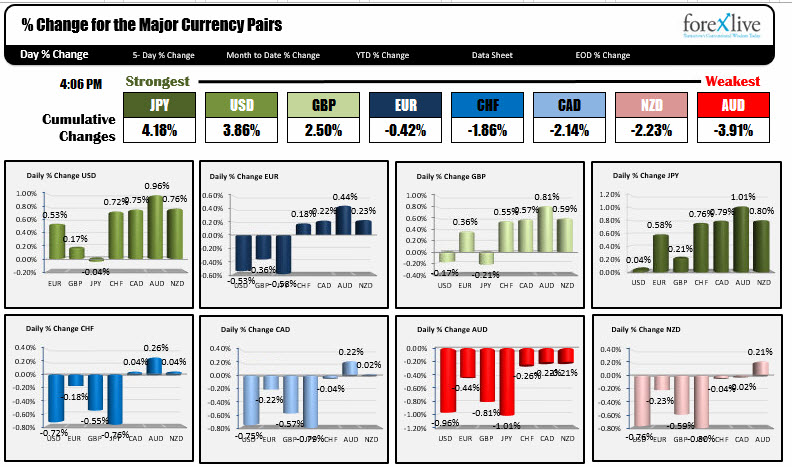

- The JPY is the strongest. The NZD is the weakest in the morning snapshot.

In other markets:

- Spot gold fell the back of the stronger dollar. It is trading down -$8 on the day or -0.62% at $1316.50

- WTI crude oil futures are up $0.23 or +0.36% at $61.18. A narrow trading range for the contract. The price is closing below the 100 and 200 hour MAs at $61.43 and $61.23.

- Bitcoin is trading down -$72 at $8228. The low reached $7666. The high extended to $8416.82. For a technical review CLICK HERE

- US stocks ending the session with mixed results. The Dow outclassed the broader indices but is closing off the highs (+295 at the highs). The Dow rose 115.54 points or 0.47%. The S&P fell -2.15 points or -0.08%. The Nasdaq fell -15.068 points or -0.20%.

- US yields are ending close to day ago levels for 5 years and out. 2 year 2.278%, up 2.0 basis points. 5 year 2.618%, up 0.7 basis points. 10 year 2.822%, up 0.5 basis points. 30 year 3.056%, unchanged.

The USD benefited from better data, a day after US retail sales disappointed.

Regional indices from Philadelphia and NY continued to be strong. The Empire Manufacturing index came in at 22.5 vs 15.0. The Philly index was a little lower than expectations at 22.3 vs 23.0 estimate, but still remains at a high level and New Orders and Employment advanced.

The weekly US initial jobless claims came in at 226K. US employment continues to shine which makes the 2 consecutive month dip in retail sales reported yesterday, seem more like an aberration. There was some speculation being tossed around that the impact from online selling is not being fully reflected in the data.

In other data, import prices rose 0.4% vs 0.2% expected.

Looking at the strongest and the weakest currencies (see table below), the JPY was the strongest, but the USD was a close 2nd.

The greenback was only lower vs. the JPY and that was only marginally. If it weren't for a late day subpoena from Mueller for documents from the Trump organization including some related to Russia, the USDJPY might have ending in the black. However, the news did send stocks falling and with it fell the USDJPY. Nevertheless, the pair did rebound into the close and trades right near the unchanged level.

Some technicals going into the last day of the trading week:

EURUSD:

The EURUSD fell below a slew of technical levels in the early NY session and really opened up the downside for the bears (see: "Don't like the EURUSD? There are a number of technical reasons to sell."). The pair moved down the 50% of the move up from the March 1 low at 1.2300 (CLICK HERE) and stalled into the close. The next downside targets include the low from Monday and the low from the US employment day last week at 1.2291 and 1.2272

respectively.

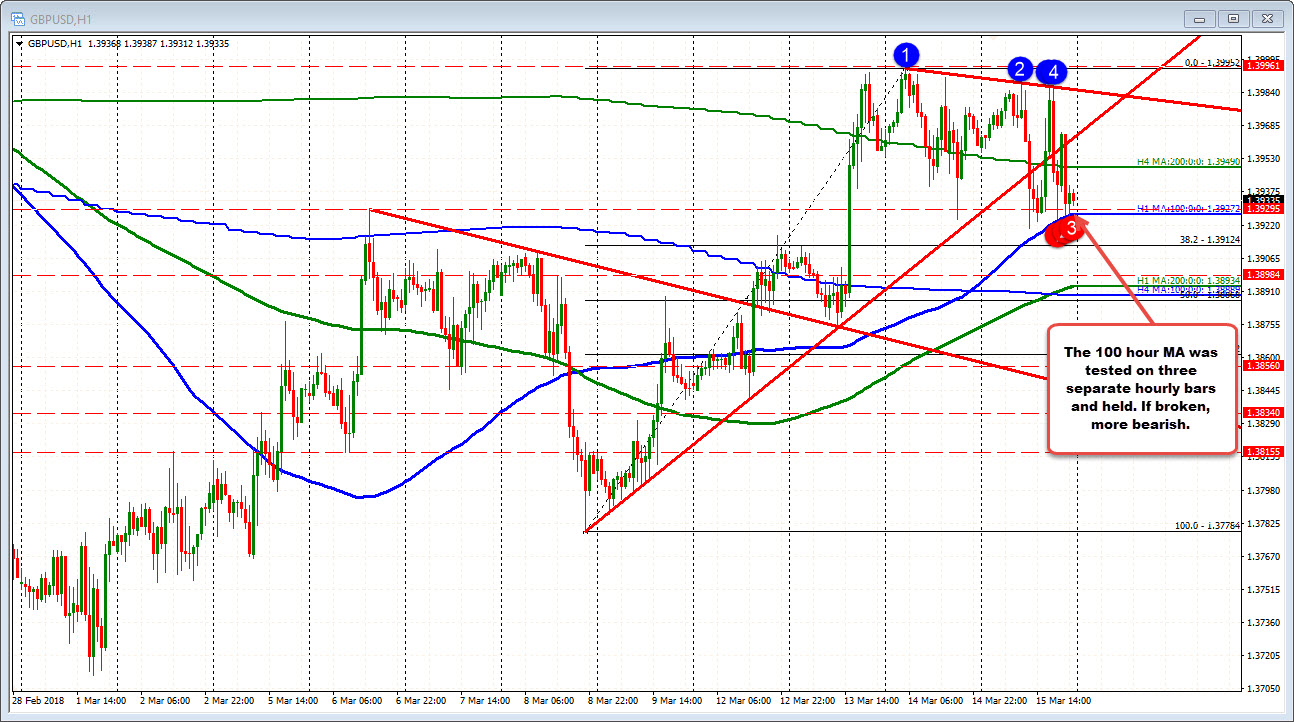

GBPUSD

The GBPUSD fell and stalled at the 100 hour MA not once, not twice buy on three separate hourly bars (see chart below. The last two occurred in the hours into the close and the bounce has been modest. That leaves the window open for a break in the new trading day. The MA comes in at 1.3927. A break below should open up the downside for more bearish potential.

However, be aware that the EURGBP fell below its 100 day MA today at 0.8846 and a lower trend line on the hourly chart below (see post here). The movement lower in that pair, helped to support the GBPUSD at times during the day. So be aware that the EURGBP cross may have a continued influence on the GBPUSD (and EURUSD as well - it helped move that pair lower today).

USDCAD

The USDCAD moved to 8 month highs today, and in the process closed above the 100 week MA at 1.2976 and the double top at 1.3000 (the pair is closing the session at 1.3042). Of the course the week does not end until 5 PM tomorrow, but as long as the price can remain above those levels than, the bulls are more in control.

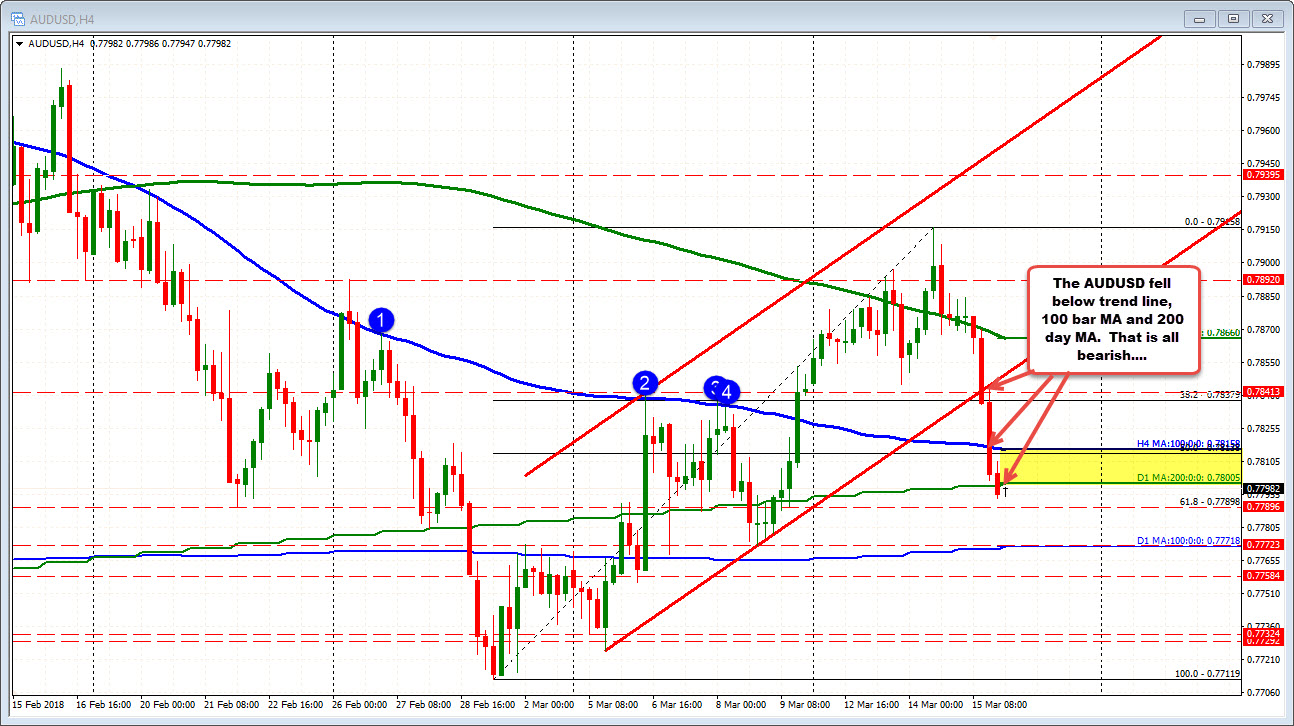

AUDUSD

The AUDUSD fell below trend line (and stayed below on a test), the 100 bar MA on the 4-hour chart at 0.78158. That is now risk. At the end of the day, the price fell below the 200 day MA at 0.7800 as well. All that is bearish. The AUD was the weakest of the day, and the technicals are showing the weakness (see post here).

That's it from me for the day. Wishing all in the Far East, a great weekend.