Forex news for NY traders on March 16, 2018

- US stock indices end session higher but not by much. Down for the week.

- CFTC commitment of traders: EUR long near record levels

- AUD/USD touches to the lowest levels of the year

- NY Fed search for a new leader is down to three people, but we don't know who

- White House says negotiations on tariff exemptions will continue through next week

- Crude oil futures settle the day at $62.34/BBL

- GBPUSD back in the black for the day after holding 50% midpoint

- The dot plot isn't the most-important forecast; this is

- European indices end the week with gains for the day. Most have modest gains for the week too.

- Baker Hughes US oil rig count 800 vs 796 prior

- Bitcoin technicals: Bitcoin longs get some upside relief

- I blame the technicals for the run higher in the crude oil contract

- Oil jumps nearly $1 for no particular fundamental reason

- Atlanta Fed GDPNow Q1 estimate cut to 1.8% from 1.9%

- US city put moratorium on commercial cryptocurrency mining

- AUDUSD swings below a key dividing area (more bearish). What defines that area?

- New York Fed cuts GDP tracking estimates for Q1 and Q2

- Le Maire says the road map will cover a full range of EU issues

- Germany's Scholz says EU must find a common answer to risk of protectionism

- Donald Trump and John Kelly reach temporary truce - report

- Former South African president to be prosecuted for corruption

- US January JOLTS job openings 6.312m vs 5.917m exp

- March prelim U Mich consumer sentiment 102.0 vs 99.3 expected

- German trade minister to fly to US to argue against tariffs

- White House chief of staff could quit today - report

- US February industrial production +1.1% vs +0.4% expected

- NY Fed business activity index 11.2 vs 15.9 prior

- Germany's Merkel wants to resolve US trade tariff disputes through talking if possible

- Canada January mftg sales mm -1.0% vs -0.9% exp

- US February housing starts 1236K vs 1290K expected

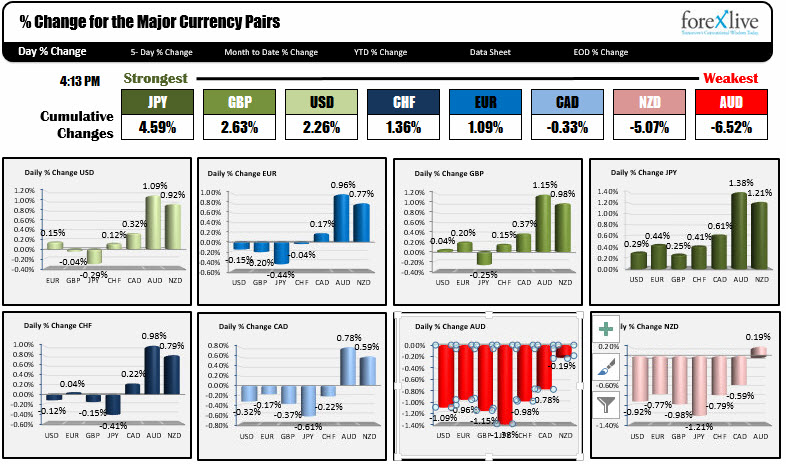

- The JPY is the strongest and the NZD is the weakest as NA trader enter for Friday

A snapshot of the markets is showing:

- Spot gold is down $2.50 or -0.19% at $1313.72

- WTI crude oil futures settled at $62.34, up $1.15 or 1.88%. For the week, the price was up about $0.30 after a dip toward $60.00 found buyers. The price moved higher despite higher inventories this week.

- Bitcoin is trading up $277 at $8528. It remains below its 200 day moving average at $9130 and also below its 100 hour MA at $8617.49. The 200 hour moving averages higher at $8909. Both moving averages are moving lower end will be eyed for bullish bearish clues during weekend trading

- US yields are higher (but off the highs for the day). 2-year 2.29%, up 0.6 basis points. 5-year 2.64%, up 1.7 basis points. 10 year 2.84%, up 1.5 basis points. 30 year 3.08%, up 1.8 basis points

- US stocks ended the session modestly higher and down for the week. The S&P closed up 0.17%. The NASDAQ was unchanged. The Dow industrial average rose by 0.29%

Trading in the NY session saw the USD move higher with the help from some better than expected economic data. However, most of the declines were vs. the AUD, NZD and the CAD. The greenback was up modestly vs the EUR and CHF, it was down vs the JPY and is closing near unchanged levels vs. the GBP (see chart below).

Overall, the JPY was the strongest currency of the major currencies, while the AUD was the weakest. The AUDUSD traded at new lows for the year.

Better data out of the US including industrial production/capacity utilization, U of Michigan consumer sentiment and the JOLT job opens. That data trumped weaker housing starts/building permits and NY business activity index. US yields moved higher with the 10 year moving up to a session high of 2.857%, up about 2.6 basis points. That helped to push the dollar higher.

As mentioned earlier, the gains vs. the greenback were mostly vs the AUD and NZD. Those pairs suffered since peaking on Wednesday with a steady stream of selling, and both the AUDUSD and the NZDUSD ended the week near session lows.

For the AUDUSD, the pair is closing around the low at 0.7709 level after trading up to a high for the week (and month) at 0.7916 on Wednesday. The low today, took out the March 1 low of 0.7711. That was the lowest the pair has traded since December 22nd. The pair is also trading back below the 200 day MA at 0.7800 and the 100 day MA at 0.77715. In next week's trading, staying below those levels will keep the bears in control.

For the NZDUSD, it peaked on Tuesday and Wednesday at 0.7354 (double top) and tumbled to a low today of 0.7207 (closing at 0.7211). The lows for March came in at 0.7202 and 0.71855 respectively. The 200 day MA is at 0.7181. Those levels will be targeted on more selling next week. If the 200 day MA can be broken, it should solicit more selling.

In other pairs today,

- The GBPUSD had a wild up, and down and back up session. The high stalled just ahead of a topside trend line. The low stalled just ahead of the 50% midpoint retracement of the move up from the March 8th low. On the final move higher, the pair stalled at the converged 100 hour MA and 200 bar MA on the 4-hour chart at 1.3945 level. That level will be a key barometer for bulls and bears in early trading next week.

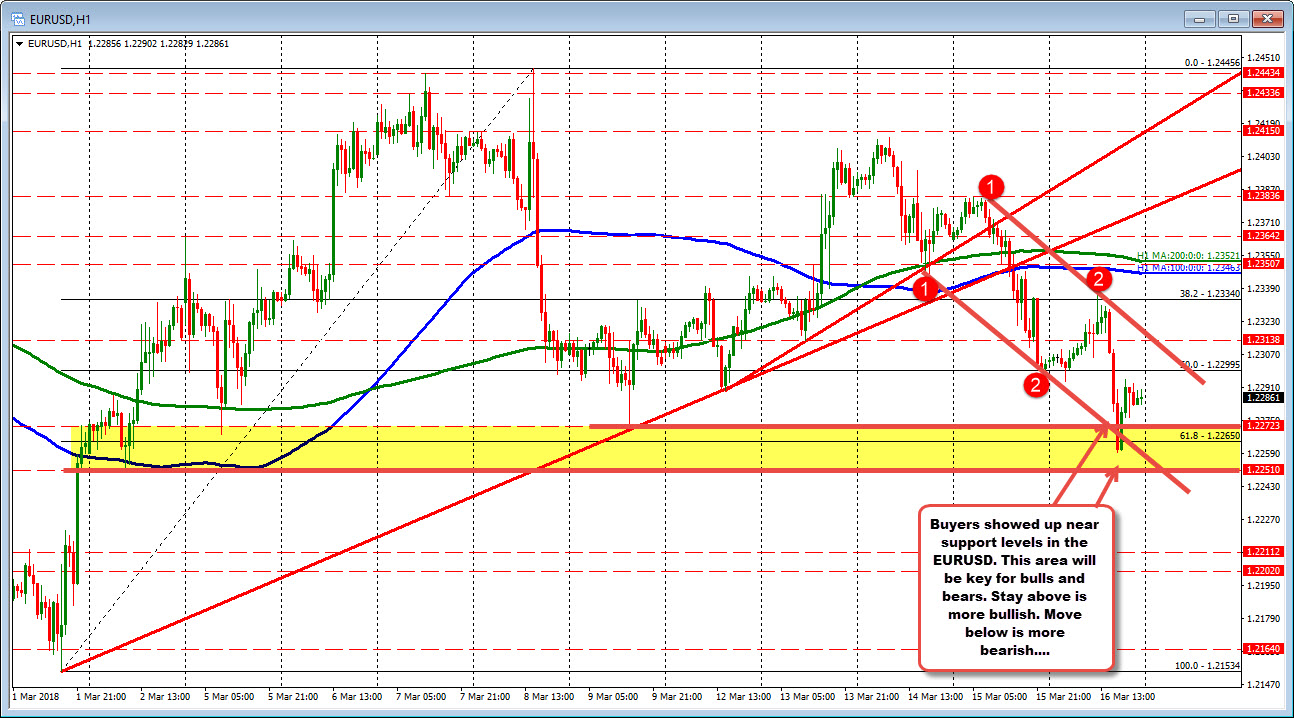

- The EURUSD worked higher in early trading today but stalled near a topside channel trend line (see red circle 2). The fall took the price below the lower channel trend line, but swing lows going back to March 2nd, stalled the fall in the 1.2251-72 area (the low reached 1.22597). Next week that area will be eyed for bullish/bearish clues.

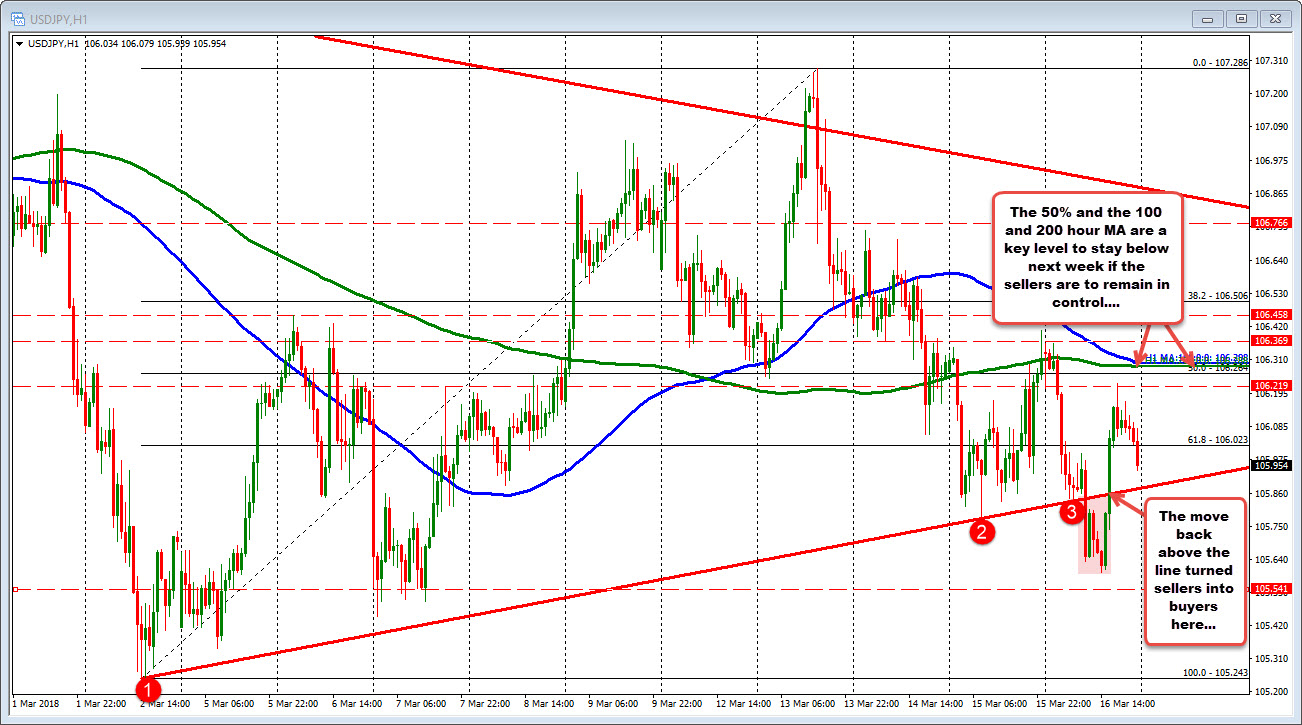

- The USDJPY also had a volatile session. Coming into the NY session, the pair was trending lower. The price fell below a lower trend line and seemed intent on heading down. The better data gave the pair a bid, and when the price moved back above a broken trend line on the daily at 105.85 (the low reached 105.597), the buying kicked back into gear. The NY session high got close to the 50% midpoint of the March trading range at 106.28 and the 100 and 200 hour MAs at 106.29 (the NY high reached 106.23), before wandering back toward 106.00 into the close. Next week, stay below 106.29 and the sellers remain in control.

Wishing all a happy and healthy weekend, and to all who celebrate St. Patrick's Day, have a great and safe celebration.