Forex news for NY trading on August 17, 2017

- US stocks end the session on the lows

- USDJPY tests lows as stocks continue to slide

- GOP Senator Bob Corker has some stinging comments on Trump

- US crude oil futures settle up $0.31 at $47.09

- More Kashkari: No need to cool the economy down

- Barcelona police arrest one suspect.

- Feds Kashkari: Will consider debt ceiling negotiations when deciding to start taper

- US Defense Sec. Mattis: US would take down any N. Korean missile

- Feds Kaplan: Still sees slack in the US labor market

- USDCHF moves to new session lows

- At least 13 dead in van crash in Barcelona - Cadena Ser radio from police sources

- Stocks extending losses. Nasdaq is down -1.0%

- White House: Gary Cohn intends to remain in his position as NEC director

- UNCONFIRMED: Gary Cohn is resigning

- US leading index for July 0.3% vs. 0.3% estimate

- US Industrial production (out early it seems) up 0.2% vs 0.3%

- US Philadelphia Fed index for August 18.9 vs 18.0 estimate

- US initial jobless claims (Aug 12th) 232K vs. 240K est.

- Canada June manufacturing sales mm -1.8% vs -1.0% exp

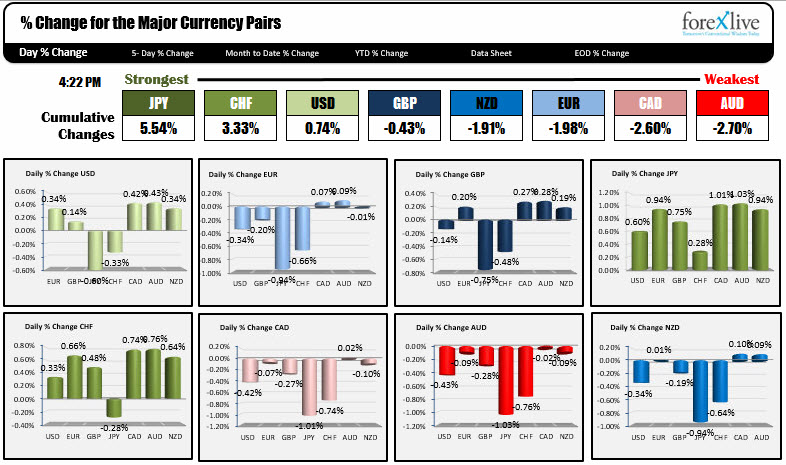

- The AUD is the strongest. The EUR is the weakest.

A snapshot of the other markets at the end of the NY session shows:

- Spot gold is up $5.00 at $1288.20

- WTI crude oil is trading up $0.20 or 0.43% to 46.99

- US yields have moved lower on safe haven flow: 2 year 1.2976%, -2.8 bp. 5 year 1.7459%, -3.6 bp. 10 year 2.18%, -4.2 bp. 30 year 2.7716%, -3.6 bp

- US stocks tumbled and closed at the lows. S&P down 1.54% to 2430.01. Nasdaq down -1.94% to 6221.91. Dow down -274.14 to 21750.

There was a terrorist attack in the heart of Barcelona. A van jumped the curve and mowed down scores of shoppers on the busy street. Thirteen people are reported to have died, a hundred are wounded/15 seriously. The police have two suspects in custody. ISIS is taking responsibility. Thoughts and prayers go out to those injured and killed in the city.

In economic news today,initial jobless claims came out better than expectations at 232K vs 240K estimate. The 4-week moving average also dipped by 500 to 240.5K. US Philly Fed index came out at the same time and was a touch higher than expectations at 18.9 vs 18.0. The dollar moved a little higher after the data. but stalled. The USDJPY specifically stalled against its 100 bar MA on the 4-hour chart at 110.40 (the high reached 110.365).

Other data today including the US industrial production and capacity utilization. Besides that data came out earlier than expectations (about 1/2 early due to someone posting it to the website), the impact was not great.

A little later at 10 AM ET/1400 GMT, the US leading index came in as expected at 0.3%.

However, at the same time there was an unconfirmed report that Gary Cohn, Trump economic advisor - and potential replacement for Janet Yellen at the end of her term as Fed chair - resigned. That did lead to a drop in the USD. The USDJPY moved to new session low at 109.72. The EURUSD - which trended lower in the London session - started to recover (lower USD). When the WH denied he was leaving it was fast break back higher in the dollar but it did not really turn the tide fully - especially against the JPY (and JPY pairs). For the USDJPY, a cluster of resistance against the 110.00 area (including 100 and 200 hour MA and 50% retracement) stalled the rally. That was the high for the NY session.

There still are hangover concerns about the Trump and the WH. So later in the day, when GOP Senator Robert Corker had some stinging comments about the President it did not help the USDJPY - nor the stock market.

Stocks which were already down, started to pick up downward momentum The news out of Barcelona was not positive as well. The major indices ended the session at the lows for the day.

The S&P and Dow each had their 2nd worst day's of the year. The S&P shed -1.54%. The Nasdaq fell -1.94%. Finally, the Dow fell by -274 points (down 1.24%). Each of the major indices ended the day at the lows. The question tomorrow (it is option expiration) will be is the big move a one day aberration, or is this the start of a bigger corrective move. If you bet the short side in 2016 you would have been wrong. Both the S&P and the Nasdaq have had closes below their 50 day MAs (today inclusive) but they have not closed below their 100 day MA since November 2017. Key day tomorrow for the stocks.

Overall, although the greenback got hit vs the JPY, currencies like the the EUR, GBP were pressured into the NY session. The terrorist action in Spain certainly did not help the EUR either. Both the EURUSD and GBPUDS, did not recover fully by the close. In addition the risk/commodity currencies like the CAD, AUD, and NZD were sold. So the dollar was mixed.

The biggest gainers were the JPY and CHF as they benefited from flight to safety flows.

Below is an end of day snapshot of the % changes of the major currencies vs each other.

Prayers again to the victims in Barcelona, their families and the medical personal who will be caring for those injured.

Wishing you all a wonderful, peace-filled weekend. After the events of the last week or so, we could use some peace.